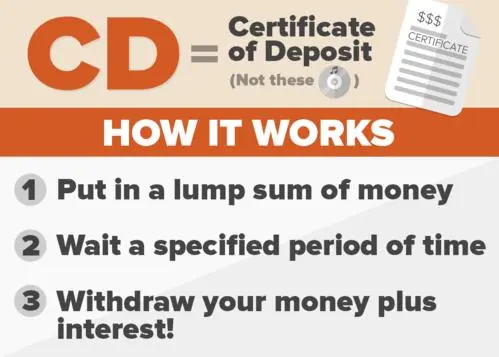

A time deposit, commonly known as a certificate of deposit (CD), is a type of savings account offered by banks and financial institutions. It operates as a fixed-term deposit where you agree to keep a specific amount of money deposited for a predetermined period, known as the term or maturity period. In return for committing your funds for this fixed period, the bank typically offers a higher interest rate compared to regular savings or checking accounts.

Here's how a time deposit operates:

1. Opening a Time Deposit:

- To open a time deposit, you'll need to visit a bank or financial institution. You can choose the amount of money you want to deposit and select a term for the deposit. Common terms range from a few months to several years.

2. Agreed Interest Rate:

- The bank and the depositor agree on an interest rate at the time of opening the time deposit. This interest rate is fixed for the entire term of the deposit.

3. Fixed Term/Maturity Period:

- A time deposit has a fixed term, during which the funds must remain on deposit. Withdrawing funds before the maturity date may result in penalties or loss of interest. The maturity period can vary, and common terms include 3 months, 6 months, 1 year, and longer.

4. Interest Payments:

- The interest earned on a time deposit is typically paid at the end of the term. However, some CDs may offer the option to receive interest payments periodically (e.g., monthly, quarterly, or annually).

5. Penalties for Early Withdrawal:

- If you withdraw funds before the maturity date, you may incur penalties. These penalties are designed to discourage early withdrawals and compensate the bank for the loss of interest.

6. Automatic Renewal Option:

- Some time deposits offer an automatic renewal option. If you choose this option, the deposit will renew for another term at the prevailing interest rate unless you instruct the bank otherwise.

7. Security and FDIC Insurance:

- Time deposits are often considered low-risk investments. In many countries, including the United States, deposits in banks are typically insured up to a certain limit by government agencies like the Federal Deposit Insurance Corporation (FDIC), providing an added layer of security.

8. Limited Liquidity:

- Time deposits are less liquid compared to regular savings or checking accounts. While you can access your funds in case of an emergency, early withdrawals may come with penalties, and you may forfeit some interest.

Time deposits are suitable for individuals who want a predictable and fixed return on their savings over a specific period. They are particularly popular among conservative investors who prioritize capital preservation and are willing to trade some liquidity for a higher interest rate. It's essential to carefully consider the terms, interest rates, and any penalties associated with early withdrawal before opening a time deposit.