Earning the highest interest on your money in a bank often involves considering different types of bank accounts and financial instruments. Here are some strategies to potentially maximize the interest you earn:

1. High-Yield Savings Account:

- Consider opening a high-yield savings account. These accounts typically offer higher interest rates than traditional savings accounts. Online banks and digital financial institutions often provide competitive rates.

2. Money Market Account:

- Money market accounts are similar to savings accounts but may offer higher interest rates. They may also provide additional features such as check-writing capabilities.

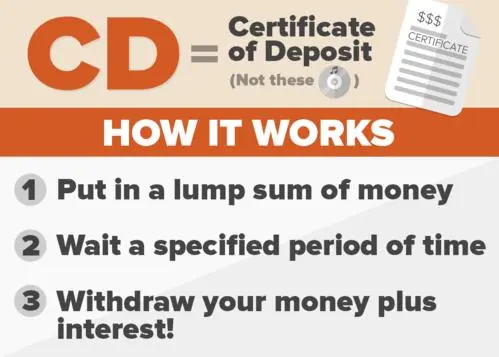

3. Certificates of Deposit (CDs):

- CDs are time deposits with fixed terms and interest rates. The longer the term, the higher the interest rate may be. However, you'll need to commit to keeping your money in the CD for the specified term to avoid penalties.

4. Look for Promotions and Special Offers:

- Some banks offer promotional interest rates or sign-up bonuses for new accounts. Keep an eye out for special offers, but make sure to understand the terms and any potential fees.

5. Consider Online Banks:

- Online banks often have lower operating costs than traditional brick-and-mortar banks, allowing them to offer higher interest rates. Research reputable online banks and compare their rates.

6. Interest-Bearing Checking Accounts:

- Some checking accounts offer interest on your balance, although the rates may be lower than those on savings accounts. Look for accounts with competitive interest rates and minimal fees.

7. Explore Rewards Checking Accounts:

- Some banks offer rewards checking accounts that provide cashback or other perks in addition to interest. However, these accounts often have specific requirements, such as a minimum number of debit card transactions per month.

8. Ladder Your CDs:

- Instead of putting all your money into a single long-term CD, consider a CD ladder. This involves dividing your money among CDs with different maturity dates. As each CD matures, you can either access the funds or reinvest them at potentially higher rates.

9. Consider Inflation-Protected Securities:

- If you're open to a bit more complexity and are willing to explore beyond traditional bank accounts, consider Treasury Inflation-Protected Securities (TIPS). These government bonds are designed to protect against inflation.

10. Stay Informed and Shop Around:

- Interest rates can change, and financial institutions may adjust their offerings. Regularly check rates from various banks and be prepared to move your money to take advantage of better opportunities.

Remember that higher interest rates often come with trade-offs, such as longer lock-in periods or specific account requirements. Additionally, consider factors like fees, accessibility, and the overall financial stability of the institution when choosing where to deposit your money. Always carefully read the terms and conditions of any account before opening it.