In today's fast-paced digital world, investing has become more accessible than ever before. Gone are the days of relying solely on traditional brokerage firms and financial advisors. With the rise of investment apps, anyone with a smartphone can now take control of their financial future. In this article, we will explore the top five investment apps of 2023, providing you with the tools and information you need to make informed investment decisions.

1. Robinhood

Robinhood has been a game-changer in the investment space since its launch in 2013. With its user-friendly interface and commission-free trades, Robinhood has revolutionized the way people invest. The app allows users to buy and sell stocks, options, ETFs, and even cryptocurrencies without paying any fees. Additionally, Robinhood offers a wide range of educational resources, making it an excellent choice for both beginner and experienced investors.

2. Acorns

Acorns is an investment app that aims to make investing effortless for everyone. The app works by rounding up your everyday purchases to the nearest dollar and investing the spare change. For example, if you spend $3.50 on a cup of coffee, Acorns will automatically invest $0.50 for you. This micro-investing approach allows users to start investing with small amounts of money without even realizing it. Acorns also offers a range of portfolio options based on your risk tolerance and financial goals.

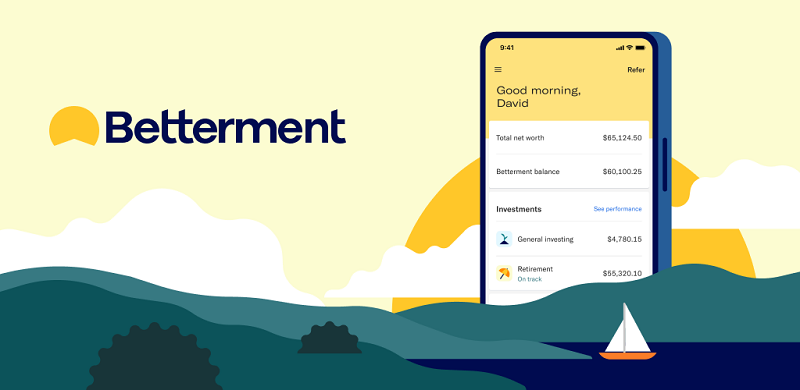

3. Betterment

Betterment is a robo-advisor that takes the guesswork out of investing. The app uses advanced algorithms to create and manage a diversified portfolio tailored to your individual needs. Betterment offers a range of portfolio options, from conservative to aggressive, allowing you to choose the level of risk that suits you best. The app also provides tax-efficient investing strategies and automatic rebalancing to ensure your portfolio stays on track.

4. Stash

Stash is an investment app that aims to make investing simple and accessible for everyone. The app offers a wide range of investment options, including individual stocks, ETFs, and themed portfolios based on your interests. Stash also provides educational content and personalized guidance to help users make informed investment decisions. With its low fees and user-friendly interface, Stash is an excellent choice for beginner investors looking to get started in the market.

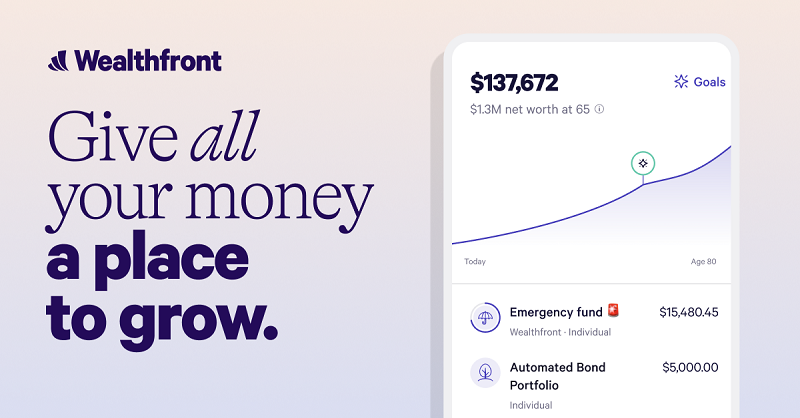

5. Wealthfront

Wealthfront is another popular robo-advisor that offers a range of investment services. The app uses advanced algorithms to create and manage a diversified portfolio based on your financial goals and risk tolerance. Wealthfront also offers additional features such as tax-loss harvesting and direct indexing to help maximize your investment returns. With its low fees and automated investment strategies, Wealthfront is a top choice for investors looking for a hands-off approach.

In conclusion, the rise of investment apps has made investing more accessible and convenient than ever before. Whether you're a beginner investor looking to get started or an experienced investor looking for new opportunities, these top five investment apps of 2023 offer the tools and resources you need to succeed. From commission-free trades to robo-advisors, these apps provide a range of options to suit every investor's needs. So why wait? Take control of your financial future today with one of these top investment apps.