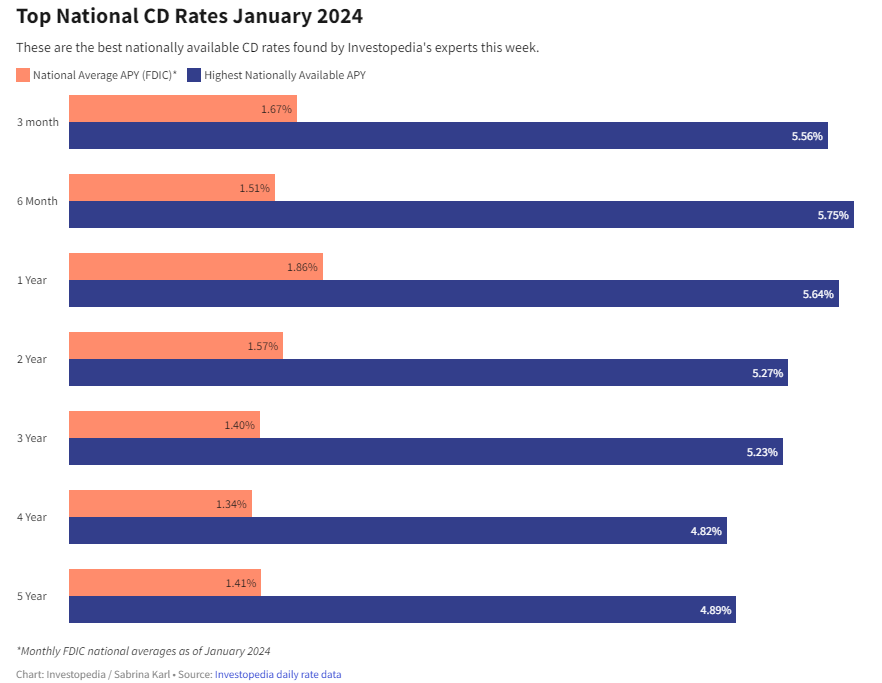

If you are looking for a safe and reliable way to grow your savings, you might want to consider opening a certificate of deposit (CD) account. A CD is a type of deposit account that offers a fixed interest rate for a specified term, usually ranging from a few months to several years. Unlike a regular savings account, you cannot withdraw your money from a CD before the term ends without paying a penalty fee. However, in exchange for this reduced liquidity, you can earn a higher interest rate than most savings accounts.

CD rates vary depending on the bank, the term, and the amount you deposit. Generally, the longer the term and the larger the deposit, the higher the rate. However, you also need to consider the inflation rate and the opportunity cost of locking up your money for a long time. Therefore, it is important to compare different CD options and find the best one for your financial goals and situation.

To help you with your search, we have compiled a list of the best CD rates for January 2024, based on data from Bankrate.com. These rates are accurate as of January 29, 2024, and are subject to change at any time. Please check with the individual banks for the latest rates and terms before opening an account.

Best CD Rates for 1-Year Term

- First Internet Bank: 5.75% APY, $1,000 minimum deposit

- Synchrony Bank: 5.65% APY, $2,000 minimum deposit

- Ally Bank: 5.60% APY, no minimum deposit

- Marcus by Goldman Sachs: 5.55% APY, $500 minimum deposit

- Discover Bank: 5.50% APY, $2,500 minimum deposit

Best CD Rates for 3-Year Term

- First Internet Bank: 6.00% APY, $1,000 minimum deposit

- Synchrony Bank: 5.90% APY, $2,000 minimum deposit

- Ally Bank: 5.85% APY, no minimum deposit

- Marcus by Goldman Sachs: 5.80% APY, $500 minimum deposit

- Discover Bank: 5.75% APY, $2,500 minimum deposit

Best CD Rates for 5-Year Term

- First Internet Bank: 6.25% APY, $1,000 minimum deposit

- Synchrony Bank: 6.15% APY, $2,000 minimum deposit

- Ally Bank: 6.10% APY, no minimum deposit

- Marcus by Goldman Sachs: 6.05% APY, $500 minimum deposit

- Discover Bank: 6.00% APY, $2,500 minimum deposit

How to Choose the Best CD for You

Before you open a CD account, you should consider the following factors:

- Your time horizon: How long can you afford to keep your money in the CD without needing it? If you are saving for a short-term goal, such as a vacation or a car, you might want to choose a shorter-term CD with a lower rate but more flexibility. If you are saving for a long-term goal, such as retirement or a house, you might want to choose a longer-term CD with a higher rate but less access to your money.

- Your risk tolerance: How comfortable are you with locking up your money for a fixed period of time? If you are worried about unexpected expenses or emergencies, you might want to keep some of your savings in a more liquid account, such as a high-yield savings account or a money market account. If you are confident that you won't need your money before the CD matures, you can take advantage of the higher interest rate offered by CDs.

- Your inflation expectations: How much do you think the prices of goods and services will increase over time? If you expect inflation to rise, you might want to avoid locking up your money in a low-rate CD for a long time, as your purchasing power will decrease over time. If you expect inflation to remain low or stable, you can benefit from the fixed-rate CD that will preserve your purchasing power.

- Your tax situation: How much will you have to pay in taxes on your CD interest income? CD interest is taxable as ordinary income, which means that it will be taxed at your marginal tax rate. Depending on your income level and tax bracket, this could reduce your effective return on your CD. You might want to consider opening a CD in a tax-advantaged account, such as an IRA or a Roth IRA, to defer or avoid taxes on your interest income.

Conclusion

CDs are a great way to save money and earn interest without taking much risk. However, not all CDs are created equal, and you need to shop around and compare different options to find the best one for you. By considering your time horizon, risk tolerance, inflation expectations, and tax situation, you can choose the CD that suits your needs and goals. Happy saving!