In a shocking revelation that rocked the corporate world, Gary Tanner, a former executive at Valeant Pharmaceuticals International, Inc., and Andrew Davenport, the former CEO of Philidor Rx Services LLC, were arrested and charged for their involvement in a multimillion-dollar kickback scheme.

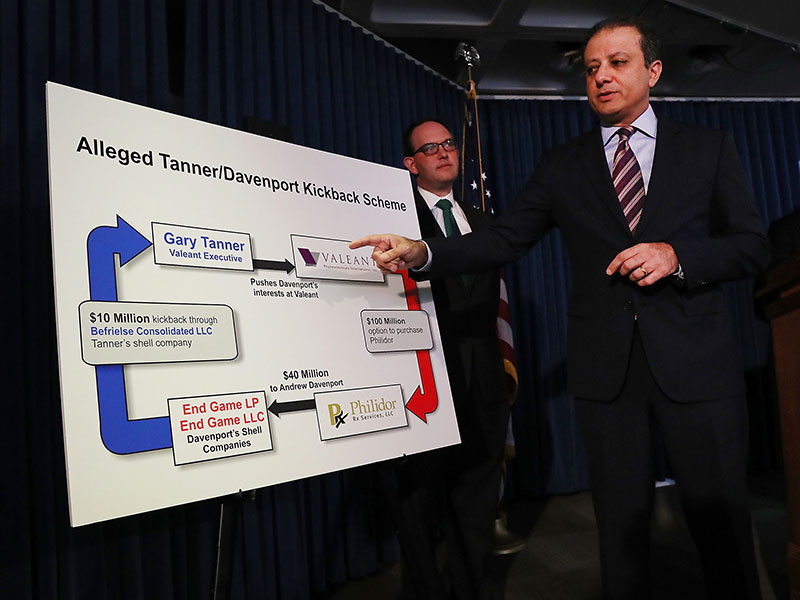

The scheme, which was meticulously planned and executed, involved a clandestine kickback payment that promised Tanner and Davenport millions of dollars in personal profits. Tanner, who was serving as a Valeant executive at the time, was allegedly working covertly with Davenport to secure a purchase option agreement between Valeant and Philidor.

Tanner is accused of promoting Philidor’s business interests by various means, including resisting business relationships with Philidor’s competitors. The scheme culminated with Valeant agreeing to pay $100m for the right to buy Philidor, resulting in Davenport earning a staggering $40m. In a final twist, Davenport allegedly kicked back $10m to Tanner.

The fallout from the scandal was significant. Both Tanner and Davenport were sentenced to 1 year and 1 day in prison by Senior United States District Judge Loretta A. Preska. The case serves as a stark reminder of the potential for corporate fraud and the importance of stringent oversight and regulation in the corporate world. It underscores the need for transparency, accountability, and ethical conduct in business dealings. As the dust settles on the Valeant-Philidor scandal, the corporate world is left to reflect on the lessons learned and the measures needed to prevent such incidents in the future.