Money creation is a complex process that involves various actors and institutions. Banks, in particular, play a crucial role in this process, as they are the ones responsible for creating most of the money in circulation. In this article, we will explore the process of money creation by banks and provide a professional perspective on its implications for the economy.

The process of money creation by banks starts with the creation of loans. When a bank grants a loan, it creates a new asset on its balance sheet, which is the loan itself. At the same time, it creates a new liability, which is the deposit made to the borrower's account. This deposit is new money that did not exist before and is now part of the money supply.

The amount of money that banks can create through loans is not unlimited, as it is constrained by various factors. One of these factors is the reserve requirement imposed by central banks. Reserve requirements are rules that require banks to hold a certain percentage of their deposits as reserves. These reserves cannot be lent out and therefore limit the amount of money that banks can create.

Another factor that limits the amount of money that banks can create is the demand for loans. Banks can only create new money if there is demand for loans from borrowers. If there is no demand for loans, banks cannot create new money, even if they have excess reserves.

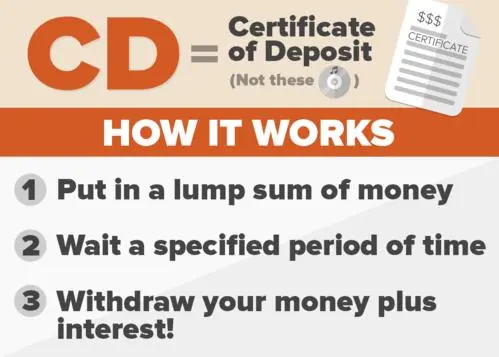

The process of money creation by banks has important implications for the economy. One of these implications is the role of banks as intermediaries between savers and borrowers. Banks use deposits from savers to lend to borrowers, creating new money in the process. This intermediation function allows savers to earn interest on their deposits and borrowers to access credit to finance their investments.

Another implication of the process of money creation by banks is its impact on the money supply and inflation. When banks create new money through loans, they increase the money supply, which can lead to inflation if the increase in the money supply exceeds the increase in real output. Central banks use various tools, such as interest rates and reserve requirements, to control the money supply and inflation.

In conclusion, the process of money creation by banks is a crucial aspect of the modern economy. Banks create most of the money in circulation through loans, which has important implications for the intermediation function of banks, the money supply, and inflation. Understanding this process is essential for policymakers, economists, and anyone interested in the functioning of the economy.