The application and prospects of artificial intelligence (AI) in financial risk management is a topic that has attracted a lot of attention and research in recent years. AI is a branch of computer science that aims to create machines or systems that can perform tasks that normally require human intelligence, such as learning, reasoning, decision making, and problem solving. Financial risk management is the process of identifying, measuring, monitoring, and controlling the potential losses or gains that may arise from financial activities, such as lending, investing, trading, or hedging.

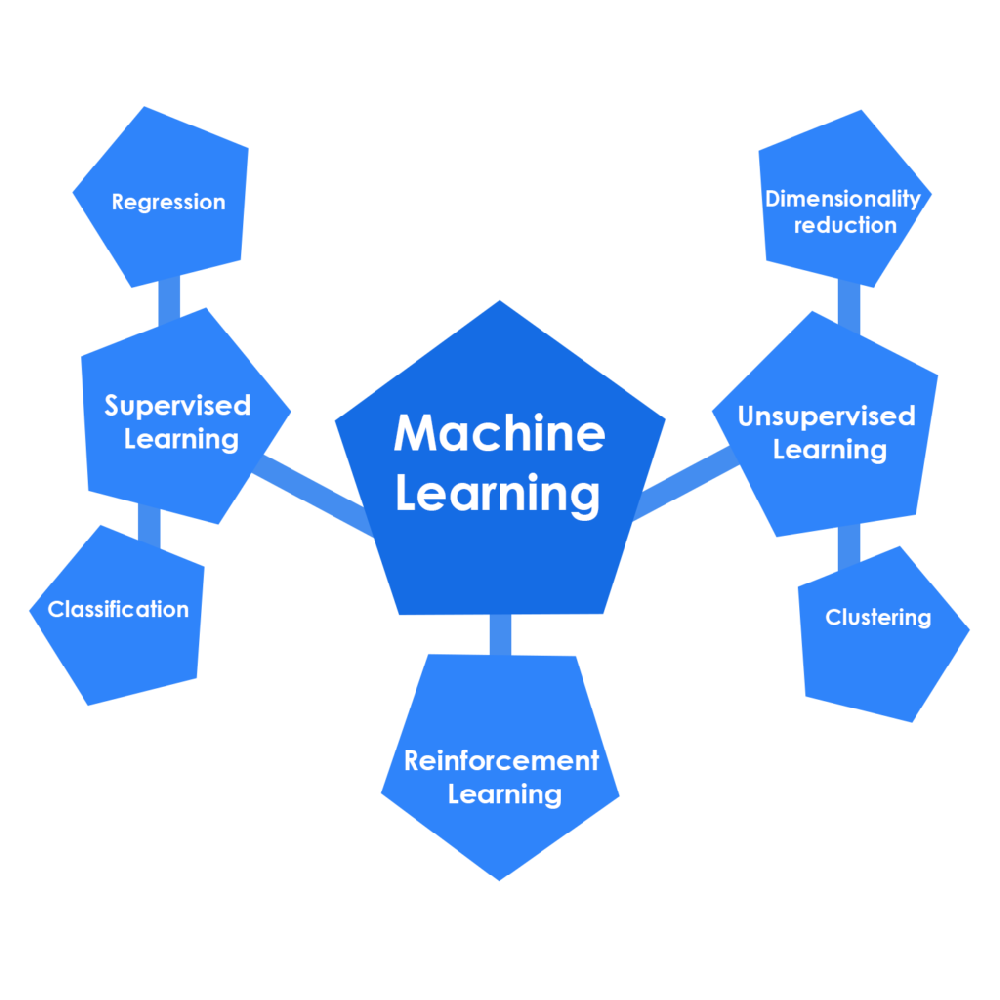

AI can be applied to financial risk management in various ways, such as:

Credit risk and credit scoring: AI can help assess the creditworthiness of borrowers, assign credit scores, and optimize credit policies and strategies. AI can also help detect and prevent default, delinquency, and fraud in credit transactions. For example, Application of Artificial Intelligence in Financial Risk Management discusses how AI can improve the accuracy and efficiency of credit risk management by using techniques such as neural networks, support vector machines, and genetic algorithms.

Forecasting and prediction: AI can help forecast and predict future trends, scenarios, and outcomes of financial markets, instruments, and indicators. AI can also help optimize portfolio allocation, asset pricing, and trading strategies. For example, Artificial Intelligence in Risk Management describes how AI can enhance the forecasting accuracy and variable selection process for stress testing and scenario analysis by using techniques such as machine learning, deep learning, and big data analytics.

Security and fraud detection: AI can help protect the security and integrity of financial data, systems, and transactions. AI can also help detect and prevent fraud, money laundering, cyberattacks, and other malicious activities. For example, Artificial Intelligence in Business Management: A Literature Review reviews how AI can improve the security and fraud detection capabilities of financial institutions by using techniques such as natural language processing, computer vision, and blockchain.

The prospects of AI in financial risk management are promising, as AI can offer many benefits, such as:

Improved efficiency and productivity: AI can automate and streamline many processes and tasks that are tedious, repetitive, or complex for humans, such as data collection, processing, analysis, and reporting. AI can also reduce human errors and biases, and increase the speed and quality of decision making.

Reduced costs and risks: AI can lower the operational, regulatory, and compliance costs of financial risk management by reducing the need for human resources, infrastructure, and supervision. AI can also lower the potential losses and increase the potential gains of financial activities by improving the risk identification, measurement, monitoring, and control.

Enhanced customer experience and satisfaction: AI can improve the customer experience and satisfaction of financial services by providing personalized, customized, and convenient solutions, such as chatbots, robo-advisors, and smart contracts. AI can also increase the customer loyalty and retention by building trust, transparency, and engagement.

However, AI also faces some challenges and limitations in financial risk management, such as:

Data quality and availability: AI relies on large volumes of high-quality and relevant data to learn and perform effectively. However, financial data can be scarce, noisy, incomplete, inconsistent, or outdated, which can affect the performance and reliability of AI models and systems. Moreover, financial data can be sensitive, confidential, or proprietary, which can raise issues of data privacy, security, and ownership.

Model complexity and interpretability: AI models and systems can be complex, opaque, and black-box, which can make it difficult to understand, explain, and validate their logic, assumptions, and outputs. This can pose challenges for the transparency, accountability, and governance of AI in financial risk management, especially when dealing with regulators, auditors, customers, and stakeholders.

Ethical and social implications: AI can have ethical and social implications for financial risk management, such as fairness, bias, discrimination, inclusion, and human dignity. For example, AI can potentially exclude, disadvantage, or harm certain groups or individuals based on their characteristics, preferences, or behaviors. Moreover, AI can potentially replace, displace, or dehumanize human workers, customers, or partners in financial services.

Therefore, to realize the full potential and benefits of AI in financial risk management, some possible solutions and suggestions are:

Data governance and management: Establish and implement data governance and management frameworks and practices to ensure the quality, availability, and security of financial data. This includes data collection, cleaning, integration, storage, protection, and sharing. Moreover, comply with the relevant data laws, regulations, and standards, such as the General Data Protection Regulation (GDPR), and respect the data rights and interests of data owners, providers, and users.

Model development and validation: Develop and validate AI models and systems using rigorous, robust, and transparent methods and techniques. This includes model design, selection, training, testing, evaluation, and improvement. Moreover, adopt and apply the relevant model standards, guidelines, and best practices, such as the Basel Committee on Banking Supervision (BCBS) Principles for Sound Stress Testing Practices and Supervision, and the Financial Stability Board (FSB) Sound Practices on the Implications of Machine Learning for Financial Stability.

Ethical and social responsibility: Adopt and apply ethical and social principles and values to guide the development and use of AI in financial risk management. This includes fairness, accountability, transparency, explainability, and human-centricity. Moreover, engage and collaborate with the relevant ethical and social stakeholders, such as regulators, policymakers, academics, civil society, and customers, to address the ethical and social implications and challenges of AI in financial services.

In conclusion, AI is a powerful and promising technology that can transform and improve financial risk management in various ways. However, AI also poses some challenges and limitations that need to be addressed and overcome. Therefore, it is important to adopt a balanced, holistic, and responsible approach to the application and prospects of AI in financial risk management.