Financial technology, or fintech, is the use of digital technology to improve and automate the delivery and use of financial services. Fintech has a significant impact on the consumer finance market, which includes products and services such as credit cards, loans, mortgages, insurance, savings, and investments. Some of the impacts of fintech on the consumer finance market are:

Increased access and inclusion: Fintech can help expand the access and inclusion of consumers to financial services, especially those who are unbanked, underbanked, or underserved by traditional financial institutions. Fintech can offer alternative and innovative solutions that are more convenient, affordable, and tailored to the needs and preferences of consumers. For example, fintech can provide digital platforms for peer-to-peer (P2P) lending, crowdfunding, microfinance, and remittances, which can lower the barriers and costs of accessing credit, funding, and transfers. Fintech can also leverage data and analytics to improve the credit scoring and risk assessment of consumers, and offer personalized and customized products and services.

Enhanced competition and innovation: Fintech can increase the competition and innovation in the consumer finance market, by challenging and disrupting the incumbent financial institutions and creating new markets and opportunities. Fintech can offer more diverse and differentiated products and services, and improve the quality and efficiency of financial service delivery. For example, fintech can provide robo-advisors, chatbots, and smart contracts, which can automate and streamline the processes and tasks of financial advice, customer service, and contract execution. Fintech can also introduce new business models and revenue streams, such as subscription-based, freemium, or commission-based models.

Improved customer experience and satisfaction: Fintech can improve the customer experience and satisfaction of financial services, by providing more convenient, transparent, and engaging solutions. Fintech can enable consumers to access and manage their financial services anytime, anywhere, and on any device, through mobile applications, websites, or social media platforms. Fintech can also provide more information and education to consumers, and empower them to make better and informed financial decisions. For example, fintech can provide financial literacy and wellness tools, such as budgeting, saving, and investing apps, which can help consumers plan and achieve their financial goals.

However, fintech also poses some challenges and risks for the consumer finance market, such as:

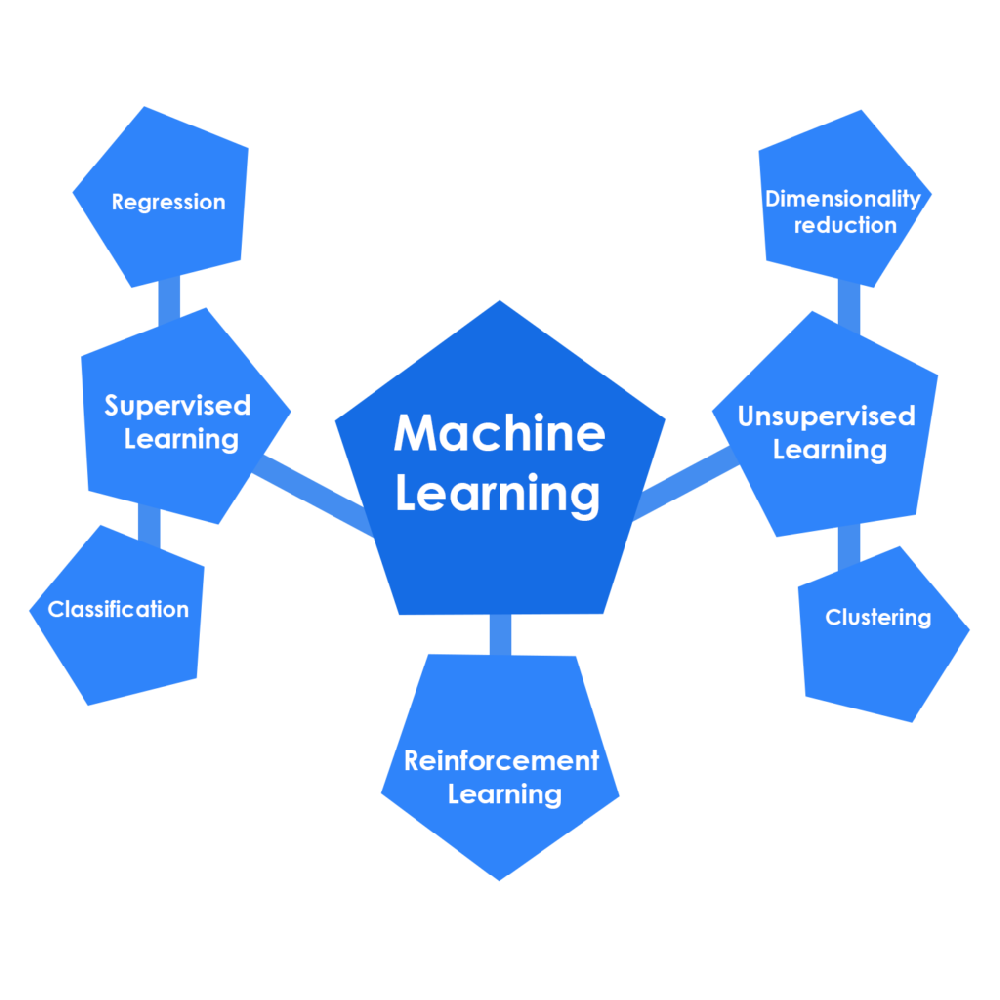

Data privacy and security: Fintech relies on the collection, processing, and sharing of large amounts of consumer data, which can raise issues of data privacy and security. Fintech can expose consumers to the risks of data breaches, cyberattacks, identity theft, and fraud, which can compromise their personal and financial information and assets. Moreover, fintech can raise ethical and legal questions about the ownership, consent, and use of consumer data, and the potential for discrimination, bias, or exclusion based on data analysis. For example, fintech can use artificial intelligence (AI) and machine learning (ML) to analyze consumer behavior and preferences, which can influence the pricing, targeting, and marketing of financial products and services.

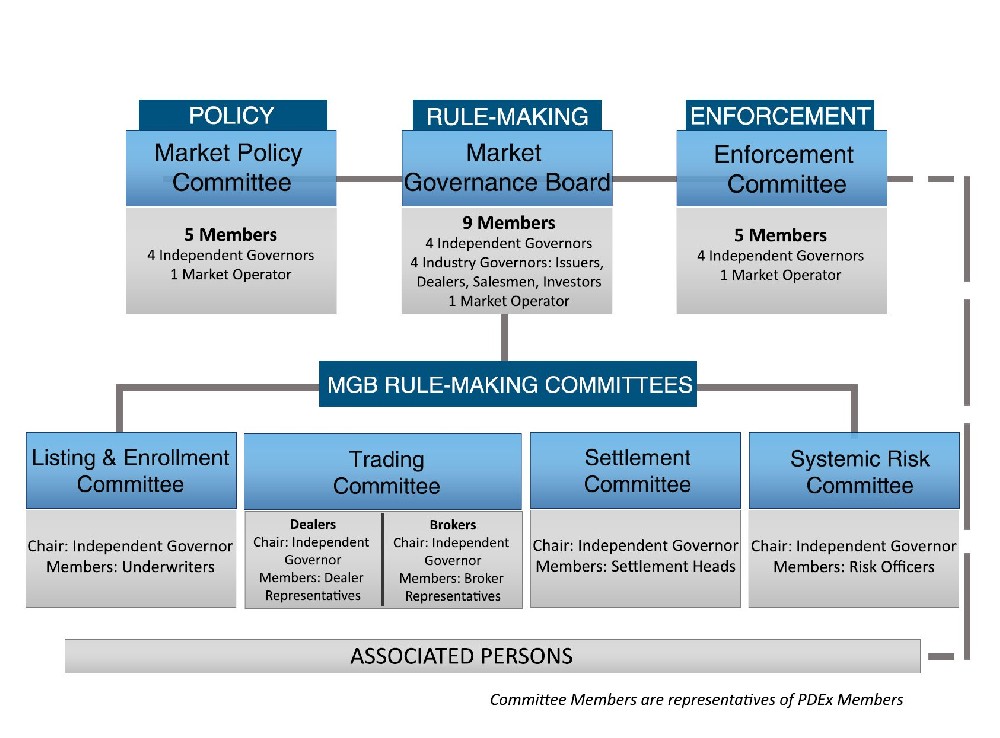

Regulatory and supervisory gaps: Fintech operates in a dynamic and evolving environment, which can create regulatory and supervisory gaps and challenges. Fintech can blur the boundaries and definitions of financial activities, entities, and sectors, and create new and complex risks and interdependencies. Fintech can also operate across different jurisdictions and markets, which can create inconsistencies and conflicts in the regulatory and supervisory frameworks and standards. For example, fintech can involve the use of cryptocurrencies, stablecoins, and central bank digital currencies (CBDCs), which can pose challenges for the regulation and supervision of money and payments.

Consumer protection and education: Fintech can create consumer protection and education issues, especially for the vulnerable and inexperienced consumers. Fintech can expose consumers to the risks of misinformation, misrepresentation, or mis-selling of financial products and services, which can result in consumer harm or loss. Fintech can also create information asymmetries and knowledge gaps between consumers and providers of financial services, which can affect the consumer awareness and understanding of their rights and responsibilities. For example, fintech can involve the use of complex and opaque algorithms and models, which can affect the transparency and explainability of financial products and services.

Therefore, to maximize the benefits and minimize the risks of fintech for the consumer finance market, some possible solutions and suggestions are:

Data governance and management: Establish and implement data governance and management frameworks and practices to ensure the quality, availability, and security of consumer data. This includes data collection, cleaning, integration, storage, protection, and sharing. Moreover, comply with the relevant data laws, regulations, and standards, such as the General Data Protection Regulation (GDPR), and respect the data rights and interests of consumers and providers of financial services.

Regulatory and supervisory innovation: Develop and adopt regulatory and supervisory innovation approaches and tools to keep pace with the fintech developments and challenges. This includes regulatory sandboxes, innovation hubs, regtech, suptech, and proportionate regulation. Moreover, coordinate and cooperate with the relevant regulatory and supervisory authorities and stakeholders, both domestically and internationally, to ensure a consistent and harmonized fintech environment.

Consumer protection and education: Enhance and enforce consumer protection and education measures and initiatives to safeguard the interests and welfare of consumers of financial services. This includes disclosure, transparency, redress, and recourse mechanisms, as well as financial literacy and awareness programs. Moreover, engage and empower consumers and providers of financial services to foster trust, confidence, and responsibility in the fintech ecosystem.

In conclusion, fintech is a powerful and promising technology that can transform and improve the consumer finance market in various ways. However, fintech also poses some challenges and risks that need to be addressed and managed. Therefore, it is important to adopt a balanced, holistic, and responsible approach to the impact of fintech on the consumer finance market.