Credit risk is an inherent part of the financial industry, and understanding its potential impact is crucial for risk management professionals. One of the key tools used to assess credit risk is the analysis of credit risk loss distributions. These distributions provide valuable insights into the potential losses that a financial institution may face due to credit defaults. In this article, we will delve into the intricacies of credit risk loss distributions, their applications, and the methodologies used to estimate them.

Understanding Credit Risk Loss Distributions:

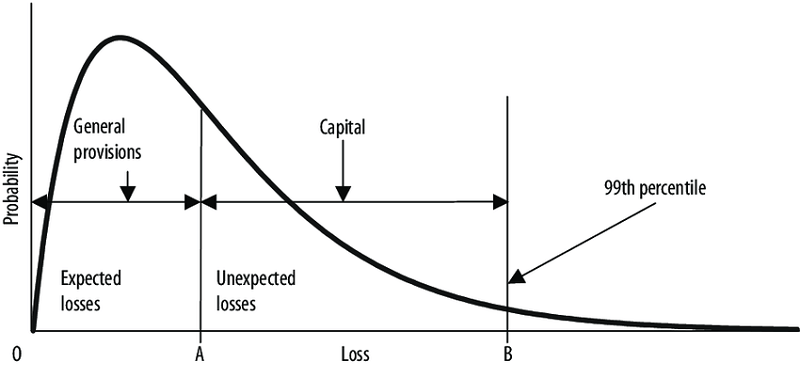

Credit risk loss distributions represent the range of potential losses that a financial institution may incur due to credit defaults. These distributions are typically derived from historical data, statistical models, and stress tests. By analyzing these distributions, risk managers can quantify the potential losses at different confidence levels and make informed decisions regarding credit risk management.

Applications of Credit Risk Loss Distributions:

Credit risk loss distributions have several important applications in the financial industry.

Firstly, they are used to estimate regulatory capital requirements. Financial institutions are required by regulatory bodies to hold a certain amount of capital as a buffer against potential credit losses. By analyzing credit risk loss distributions, risk managers can determine the appropriate level of capital that needs to be held.

Secondly, credit risk loss distributions are used for portfolio risk assessment. Financial institutions often have large portfolios consisting of various types of credit exposures. By analyzing the loss distributions of individual credits and aggregating them, risk managers can assess the overall credit risk of the portfolio. This information is crucial for portfolio optimization and diversification.

Thirdly, credit risk loss distributions are used for stress testing. Stress testing involves assessing the impact of adverse economic conditions on a financial institution's credit portfolio. By subjecting the portfolio to various stress scenarios and analyzing the resulting loss distributions, risk managers can evaluate the resilience of the institution's capital and liquidity positions.

Methodologies for Estimating Credit Risk Loss Distributions:

There are several methodologies used to estimate credit risk loss distributions. One commonly used approach is historical simulation, which involves using historical data on default rates and recovery rates to generate loss distributions. This approach assumes that future default rates will be similar to those observed in the past.

Another approach is based on statistical models such as the Gaussian copula model or the Vasicek model. These models use statistical techniques to estimate the correlation between default probabilities of different credits and generate loss distributions based on these correlations.

Monte Carlo simulation is another widely used methodology for estimating credit risk loss distributions. This approach involves generating random scenarios for default rates and recovery rates and simulating the resulting loss distributions. Monte Carlo simulation allows for the incorporation of various factors such as macroeconomic variables and market conditions.

Credit risk loss distributions play a crucial role in assessing and managing credit risk in the financial industry. By analyzing these distributions, risk managers can quantify potential losses, estimate regulatory capital requirements, assess portfolio risk, and conduct stress tests. The methodologies used to estimate these distributions are diverse and include historical simulation, statistical models, and Monte Carlo simulation. Overall, a thorough understanding of credit risk loss distributions is essential for effective credit risk management in financial institutions.