A finance manager plays a crucial role in the success and growth of an organization. They are responsible for the management and control of the financial resources of a company, ensuring that financial goals are met and financial risks are minimized. In this article, we will explore the key responsibilities and skills required to excel in this role.

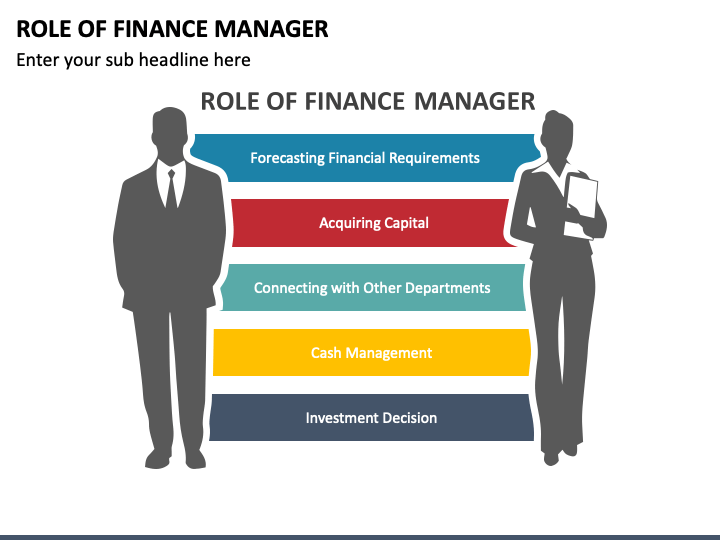

One of the primary responsibilities of a finance manager is to oversee the financial planning and analysis process. This involves developing and implementing financial strategies, setting financial goals, and monitoring the financial performance of the organization. By analyzing financial data and market trends, finance managers can provide valuable insights and recommendations to senior management for effective decision-making.

Another important aspect of the role is managing the company's cash flow. Finance managers are responsible for ensuring that there is enough cash available to meet the organization's operational needs and financial obligations. They must monitor cash inflows and outflows, forecast cash requirements, and develop strategies to optimize cash utilization. Effective cash flow management is essential for maintaining the financial stability and liquidity of the company.

Risk management is also a critical function of a finance manager. They must identify and assess financial risks such as market volatility, credit risk, and liquidity risk. By developing risk mitigation strategies and implementing appropriate controls, finance managers can protect the organization from potential financial losses. This requires a deep understanding of financial markets, regulatory frameworks, and risk management techniques.

In addition to financial planning and risk management, finance managers are responsible for financial reporting and compliance. They must ensure that the company's financial statements are accurate, transparent, and compliant with relevant accounting standards and regulations. This involves preparing financial reports, coordinating external audits, and liaising with regulatory authorities. Timely and accurate financial reporting is crucial for maintaining the trust and confidence of stakeholders, including investors, lenders, and regulators.

Furthermore, finance managers play a key role in capital budgeting and investment analysis. They evaluate investment opportunities, assess their financial feasibility, and make recommendations on capital allocation. By analyzing the potential returns and risks associated with different investment options, finance managers can help the organization make informed investment decisions that maximize shareholder value.

To excel in this role, finance managers must possess a range of skills and competencies. Strong analytical skills are essential for analyzing complex financial data and identifying trends and patterns. Excellent communication skills are also crucial for effectively communicating financial information to stakeholders at all levels of the organization. Additionally, finance managers must have a deep understanding of financial markets, accounting principles, and regulatory frameworks.

The role of a finance manager is multifaceted and critical to the success of an organization. They are responsible for financial planning, cash flow management, risk management, financial reporting, and investment analysis. By effectively executing these responsibilities and leveraging their skills and competencies, finance managers can contribute significantly to the financial health and growth of the company.