The future development trends of internet finance and its impact on commercial banks are very important topics for the financial industry and society. Based on the web search results, I can provide you with some general information and insights.

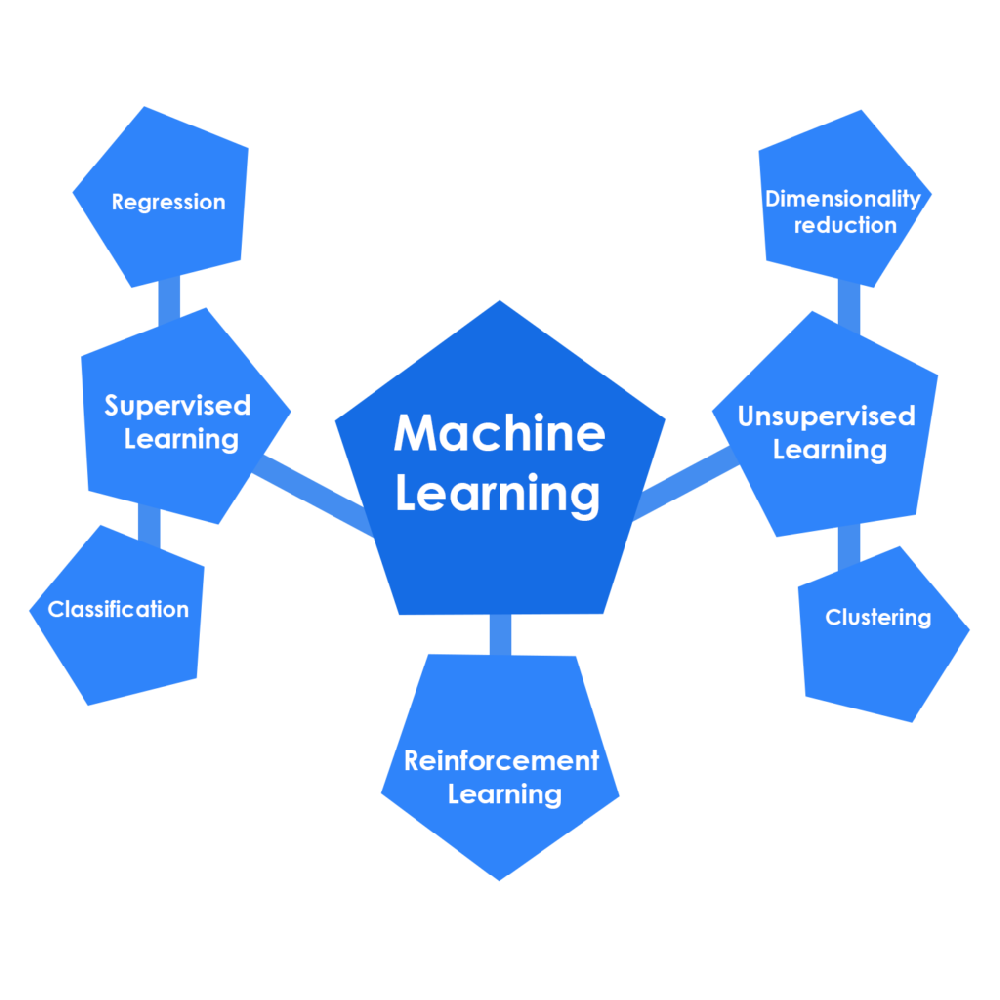

Internet finance is an emerging field that combines the traditional financial industry with the spirit of the internet. It involves various innovations and applications of internet technologies, such as big data, cloud computing, blockchain, and artificial intelligence, in the financial sector. Internet finance can provide more convenient, efficient, inclusive, and diversified financial services to customers, such as online payment, online lending, online wealth management, online insurance, and online crowdfunding.

The development of internet finance has also brought significant challenges and opportunities for commercial banks, which are the main players in the traditional financial system. On the one hand, internet finance has increased the competition and pressure for commercial banks, as it has attracted a large number of customers and funds away from the banks with its advantages of low cost, high return, and high liquidity. Internet finance has also exposed the weaknesses and problems of commercial banks, such as low efficiency, high risk, and poor service quality. On the other hand, internet finance has also stimulated the innovation and transformation of commercial banks, as it has encouraged them to adopt new technologies, business models, and strategies to cope with the changing market environment and customer demand. Internet finance has also created new opportunities and cooperation for commercial banks, as it has expanded the scope and scale of the financial market and enhanced the financial inclusion and stability.

Therefore, the future development trends of internet finance and its impact on commercial banks are likely to be: