Stock investment is one of the most challenging and competitive industries in the world, as it requires a high level of skill, knowledge, discipline, and luck to succeed. According to the web search results I found, some of the reasons why stock investment is so difficult are:

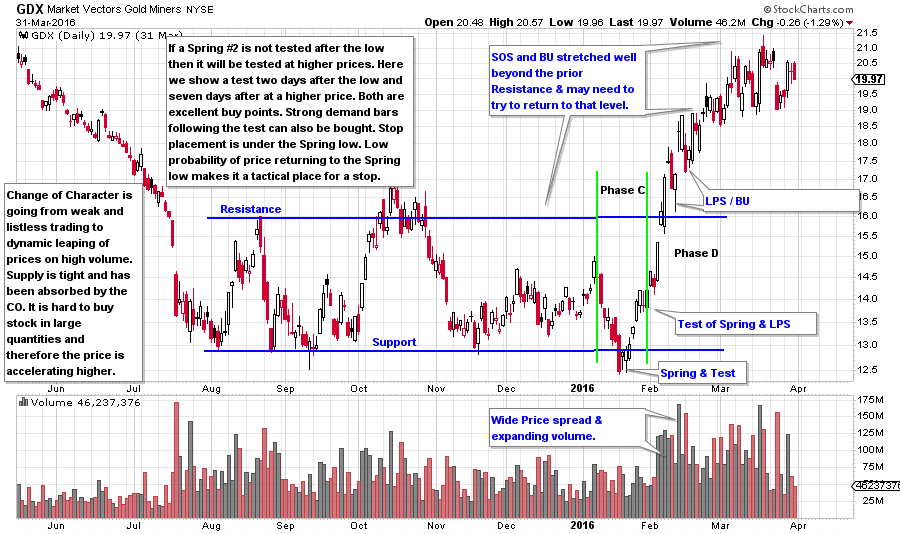

The market is highly efficient and reflects the available information rapidly. This makes it hard for stock pickers to identify underpriced or overpriced stocks with any regularity.

The supply of capital chasing performance has increased dramatically in the past few decades, as more investors enter the market through mutual funds, hedge funds, ETFs, and other vehicles. This creates more competition and reduces the opportunities for alpha.

The pool of victims has shrunk, as more investors adopt passive strategies that mimic the market index. This reduces the chances of exploiting the mistakes of uninformed or irrational investors.

The speed and volume of information has become overwhelming, as investors have access to more sources of data, news, opinions, and analysis. This makes it difficult to filter out the noise and focus on the signal.

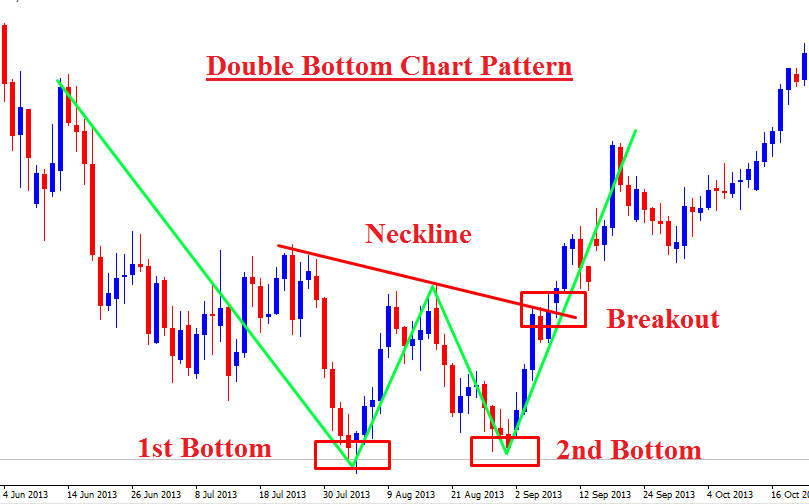

The market is unpredictable and influenced by many factors, such as economic conditions, political events, social trends, technological innovations, and natural disasters. These factors can create uncertainty and volatility, which can affect the investor sentiment and market behavior.

The market is subject to behavioral biases and emotions, such as overconfidence, confirmation bias, loss aversion, and herd mentality. These biases and emotions can cloud the judgment and decision-making of investors, leading to suboptimal outcomes.

These are some of the reasons why stock investment is a tough industry to succeed in. However, this does not mean that it is impossible or hopeless. Some investors have managed to achieve consistent and superior performance over time, such as Warren Buffett, Peter Lynch, and George Soros. These investors have demonstrated some common traits, such as:

Having a clear and disciplined investment philosophy and process, based on sound principles and evidence.

Having a long-term perspective and a contrarian mindset, avoiding the short-term noise and the crowd mentality.

Having a diversified and balanced portfolio, aligned with their risk tolerance and investment goals.

Having a continuous learning and improvement attitude, seeking feedback and learning from their mistakes.

These are some of the qualities that can help investors overcome the difficulties and achieve success in the stock market. However, they are not easy to acquire or maintain, and they require a lot of effort and dedication. Therefore, stock investment is not for everyone, and it is important to understand the risks and rewards involved before entering the industry.