One of the first steps to learn how to invest in stocks is to open a brokerage account. A brokerage account is an account that allows you to buy and sell stocks and other securities through a broker, who is a person or a company that acts as an intermediary between you and the stock market. You can choose from different types of brokers, such as full-service brokers, discount brokers, or online brokers, depending on your needs, preferences, and budget. Some of the factors that you should consider when choosing a broker are the fees, commissions, services, platforms, tools, and customer support that they offer. You can compare and review different brokers on websites such as or .

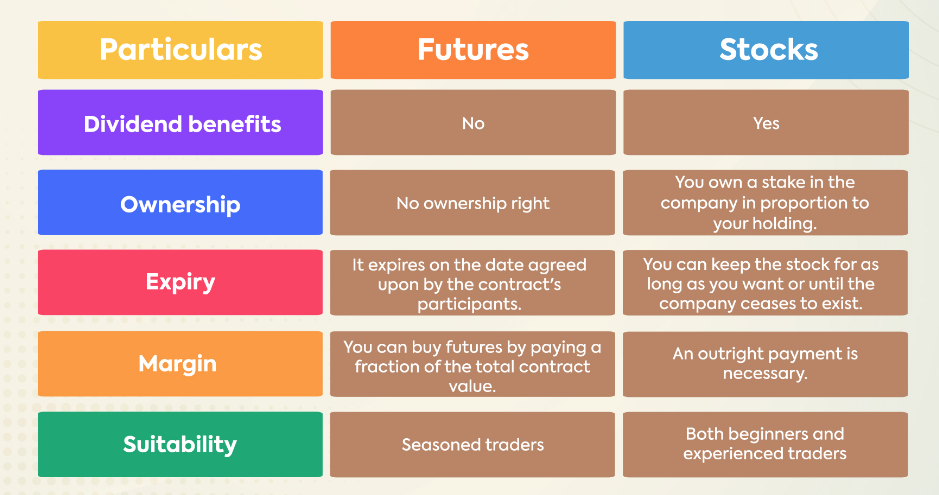

Another step to learn how to invest in stocks is to decide on your investment goals, risk tolerance, and investing style. Your investment goals are the specific and measurable outcomes that you want to achieve with your money, such as saving for retirement, buying a house, or funding your education. Your risk tolerance is the amount of risk that you are willing and able to take with your money, which depends on your personality, age, income, and financial situation. Your investing style is the approach that you use to select and manage your investments, which can range from active to passive, and from long-term to short-term. You should align your investment goals, risk tolerance, and investing style with the types of stocks that you invest in, such as growth stocks, value stocks, dividend stocks, or sector stocks.

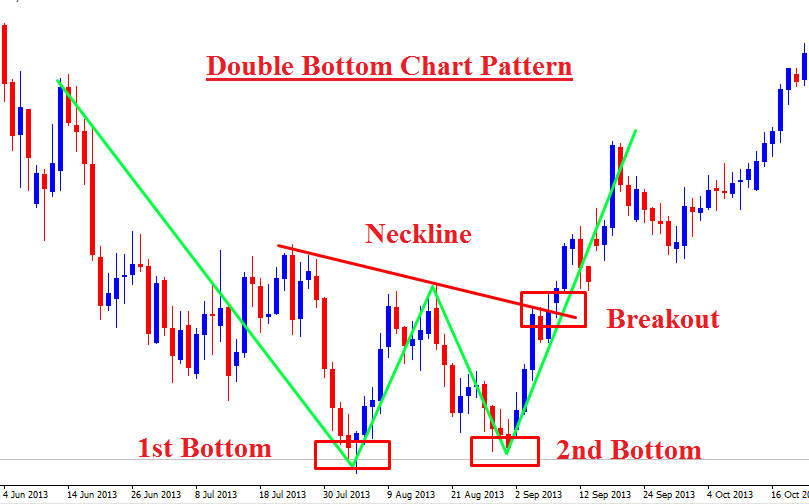

A third step to learn how to invest in stocks is to research and analyze the stocks that you are interested in. You should not invest in a stock based on a tip, a rumor, or a hunch, but rather on solid information and evidence. You should use both fundamental analysis and technical analysis to evaluate the performance, potential, and value of a stock. Fundamental analysis is the method of examining the financial statements, earnings, assets, liabilities, growth prospects, competitive advantage, and industry trends of a company. Technical analysis is the method of studying the price movements, patterns, trends, and indicators of a stock. You can use various tools and resources to conduct your research and analysis, such as financial websites, news outlets, company reports, analyst ratings, charts, and software.

A fourth step to learn how to invest in stocks is to diversify your portfolio. Diversification is the practice of spreading your money across different types of stocks and other asset classes, such as bonds, mutual funds, exchange-traded funds (ETFs), real estate, commodities, and cryptocurrencies. Diversification can help you reduce your risk, increase your returns, and avoid emotional investing. You can diversify your portfolio by investing in stocks from different sectors, industries, markets, countries, and sizes. You can also use tools such as robo-advisors, index funds, or ETFs to diversify your portfolio automatically and efficiently.

A fifth step to learn how to invest in stocks is to monitor and adjust your portfolio. You should not invest in stocks and forget about them, but rather keep track of their performance and progress. You should review your portfolio periodically, such as monthly, quarterly, or annually, and compare it with your investment goals, risk tolerance, and investing style. You should also check the market conditions, the economic environment, and the news events that may affect your stocks. You should then make any necessary changes to your portfolio, such as rebalancing, adding, or selling your stocks, to maintain your desired level of diversification, risk, and return.

These are some of the basic steps and strategies that can help you learn how to invest in stocks. However, there is much more that you can and should learn about the stock market and its intricacies. You can find more information and guidance on how to invest in stocks from various sources, such as books, podcasts, courses, blogs, videos, and mentors. Some of the examples of these sources are:

, a classic book by Benjamin Graham that teaches the principles of value investing and how to analyze stocks.

, a website that provides stock market news, analysis, advice, and recommendations for beginners and experts alike.

, a free online course by Udemy that covers the basics of the stock market and how to invest in stocks.

, a blog by The Balance that offers educational articles, tips, and resources on how to invest in stocks.

, a video by ClearValue Tax that explains what stocks are, how to open a brokerage account, how to buy and sell stocks, and how to choose a style of investing.

I hope this information helps you learn how to invest in stocks. Remember, investing in stocks can be rewarding, but it can also be challenging and risky. Therefore, you should always do your own research, analysis, and risk management before you invest in any stock. You should also start small, be patient, and be consistent. Happy investing!