The trend of the stock and the market: One of the core points of choosing stock purchase entry is to identify the direction and strength of the trend of the stock and the market. A trend is the general tendency of the price to move in a certain direction over time. A stock that is in an uptrend (making higher highs and higher lows) is likely to continue rising, while a stock that is in a downtrend (making lower highs and lower lows) is likely to continue falling. A market that is in an uptrend (making higher highs and higher lows) is likely to support the rise of most stocks, while a market that is in a downtrend (making lower highs and lower lows) is likely to drag down most stocks. Therefore, one of the core points of choosing stock purchase entry is to buy stocks that are in an uptrend and avoid stocks that are in a downtrend, and to buy stocks when the market is in an uptrend and avoid stocks when the market is in a downtrend.

The valuation of the stock: Another core point of choosing stock purchase entry is to evaluate the valuation of the stock. Valuation is the process of estimating the fair or intrinsic value of a stock based on its financial performance, growth prospects, competitive advantage, and other factors. A stock that is undervalued (trading below its fair value) is likely to appreciate, while a stock that is overvalued (trading above its fair value) is likely to depreciate. Therefore, another core point of choosing stock purchase entry is to buy stocks that are undervalued and avoid stocks that are overvalued, and to buy stocks when they are trading at a discount to their fair value and avoid stocks when they are trading at a premium to their fair value

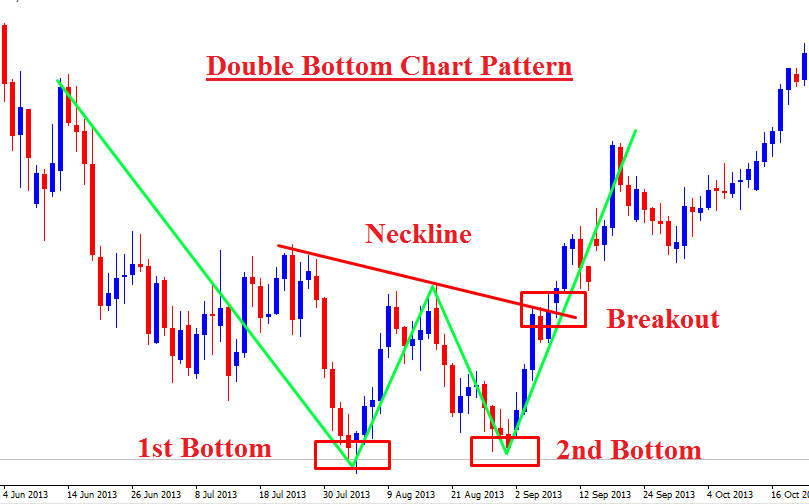

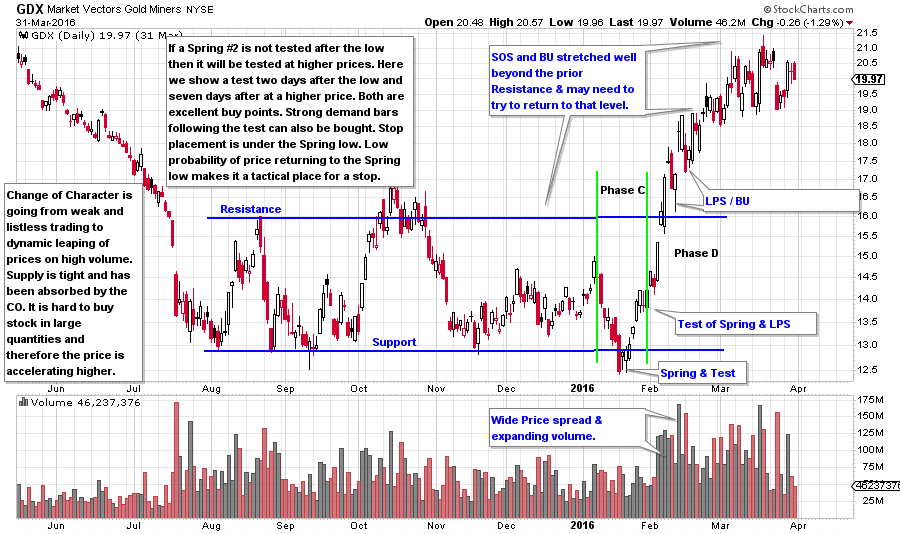

The technical indicators and chart patterns of the stock: A third core point of choosing stock purchase entry is to use technical indicators and chart patterns of the stock. Technical indicators and chart patterns are tools that use historical price and volume data to analyze the behavior and sentiment of the market and the stock. They can help identify trends, patterns, support and resistance levels, and other signals that can indicate the best time to buy or sell a stock. For example, some common technical indicators and chart patterns that can help find stock purchase entry points are:

Breakouts: A breakout is when the price of a stock moves above a resistance level or below a support level, indicating a change in the supply and demand balance and a continuation or reversal of the trend. A breakout can be a signal to buy a stock if it occurs in the direction of the trend, especially if it is accompanied by high volume and confirmed by other indicators.

Pullbacks: A pullback is when the price of a stock retraces or corrects a portion of its previous move, indicating a temporary pause or consolidation in the trend. A pullback can be a signal to buy a stock if it occurs in the direction of the trend, especially if it reaches a support level or a Fibonacci retracement level, and bounces back with high volume and confirmed by other indicators.

Moving averages: A moving average is a line that shows the average price of a stock over a certain period of time, smoothing out the fluctuations and highlighting the trend. A moving average can be a signal to buy a stock if it crosses above another moving average (a bullish crossover), indicating a change in the momentum and direction of the trend, especially if it is confirmed by other indicators.

These are some of the core points of choosing stock purchase entry, but they are not the only ones. Investors and traders should also consider their own goals, risk preferences, and investment styles when deciding when and how to buy stocks. They should also do their own due diligence and research the company, its industry, its competitors, its financials, its growth prospects, and its valuation. They should also use other technical indicators and fundamental analysis to confirm their trading decisions and manage their risk.