First, you should understand your level of risk and decide what is appropriate for your portfolio. Risk and return are often correlated, meaning that higher-risk stocks may offer higher potential returns, but also higher chances of losses. You should consider your time horizon, financial situation, and personal temperament when assessing your risk tolerance. You should also diversify your portfolio across different sectors, industries, and asset classes to reduce your exposure to any single source of risk.

Second, you should develop a strategy for choosing stocks to invest in. There are many different approaches to stock picking, such as fundamental analysis, technical analysis, value investing, growth investing, dividend investing, and more. You should research and learn about the pros and cons of each method and find one that suits your personality and goals. You should also be consistent and disciplined in following your strategy and avoid being swayed by emotions, rumors, or market noise.

Third, you should start by picking one stock and then analyze the results. You should not invest in a stock based on a hunch, a tip, or a headline. You should do your own due diligence and research the company, its industry, its competitors, its financials, its growth prospects, and its valuation. You should also monitor the performance of the stock and compare it with your expectations and benchmarks. You should review your portfolio periodically and make adjustments as needed.

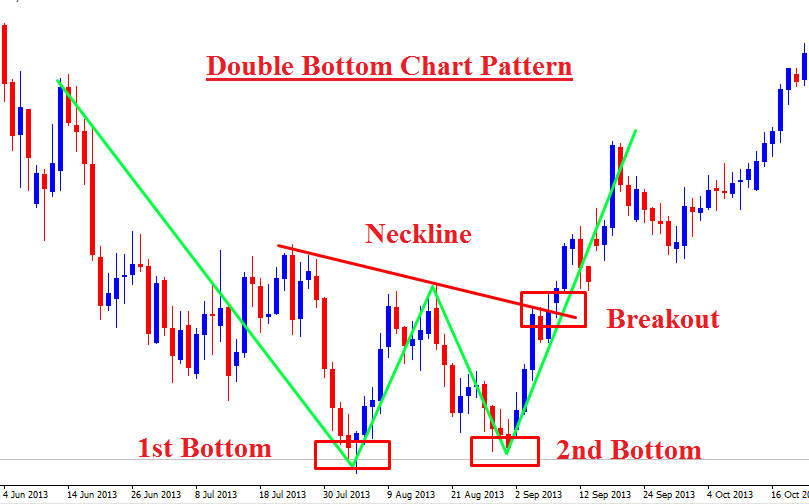

Finally, you should use trading charts to understand the movement of stocks and the overall market. Trading charts are graphical representations of price and volume data over time. They can help you identify trends, patterns, support and resistance levels, and other technical indicators that can influence the behavior of stocks. You should learn how to read and interpret trading charts and use them as a tool to complement your analysis and strategy.

If you want to learn more about how to pick stocks, you can check out some of the resources I found for you:

- This article provides an overview of some of the common strategies and factors to consider when picking stocks.

- This article explains some of the basic principles and guidelines for picking stocks as a beginner.

- This article offers some practical advice and tips for new investors who want to pick stocks.

- This article outlines the steps to follow when picking a stock, from finding an investing theme to screening and analyzing potential candidates.

- This article describes five steps for beginners to pick a stock, from determining their goals to understanding systematic risk.