The stock market is a place where buyers and sellers of stocks, which are shares of ownership in a company, meet and trade. The stock market has many benefits for both companies and investors. Companies can raise money from investors by selling their stocks, and investors can earn money from their stocks by receiving dividends or selling them at a higher price than they bought them.

There are many factors that affect the price of a stock, such as the company’s earnings, growth prospects, industry trends, market sentiment, supply and demand, and news events. The stock market is also influenced by the overall economic conditions, such as inflation, interest rates, GDP, and unemployment. The stock market can be volatile and unpredictable, as prices can change rapidly and unexpectedly.

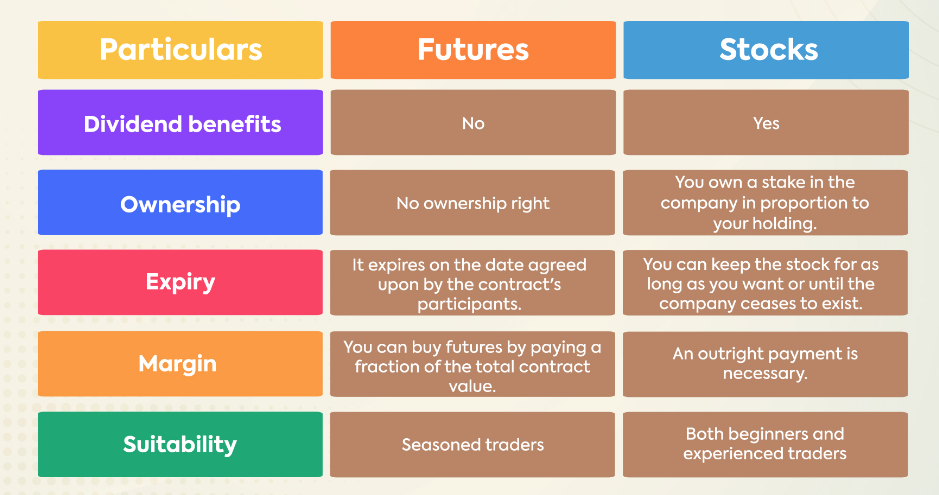

One of the most important concepts to understand about the stock market is the difference between long-term investing and short-term trading. Long-term investing is when you buy and hold stocks for a long period of time, usually years or decades, with the expectation that they will increase in value over time. Short-term trading is when you buy and sell stocks within a short period of time, usually days, weeks, or months, with the aim of making a quick profit from price fluctuations.

Long-term investing and short-term trading have different advantages and disadvantages, risks and rewards, strategies and techniques, and tax implications. Generally speaking, long-term investing is more suitable for beginners, as it requires less time, effort, and skill, and has lower costs and taxes. Long-term investing also allows you to benefit from the power of compounding, which is when your returns generate more returns over time.

Another key concept to grasp about the stock market is the importance of diversifying your portfolio. Diversifying your portfolio means spreading your money across different types of stocks, such as large-cap, mid-cap, small-cap, growth, value, dividend, and sector stocks. Diversifying your portfolio also means investing in other asset classes, such as bonds, mutual funds, exchange-traded funds (ETFs), real estate, commodities, and cryptocurrencies.

Diversifying your portfolio can help you reduce your risk, as different stocks and assets tend to perform differently in different market conditions. Diversifying your portfolio can also help you increase your returns, as you can capture the growth potential of various stocks and assets. Diversifying your portfolio can also help you avoid emotional investing, as you can balance your losses and gains across your portfolio.

If you want to learn more about the stock market, there are many resources available online that can help you. Some of the websites that I found useful are:

: This website provides stock market news, analysis, advice, and recommendations for beginners and experts alike. It also offers various services, such as newsletters, podcasts, courses, and premium subscriptions.

: This website provides financial guidance, tools, and reviews for various topics, such as investing, banking, credit cards, loans, and insurance. It also offers a comparison tool for online brokers and robo-advisors, as well as a calculator for retirement planning.

: This website provides educational articles, videos, quizzes, and tutorials on various financial topics, such as the stock market, economics, accounting, personal finance, and trading. It also offers a stock simulator, a dictionary, and a financial advisor network.

I hope this information helps you get started with your stock knowledge. Remember, the stock market is not a get-rich-quick scheme, but a long-term wealth-building tool. The more you learn, the more you can earn. Happy investing!