Systematic learning is a process of acquiring knowledge and skills in a planned and organized way. There are many ways to systematically learn stock investment, but here are some common steps that you can follow:

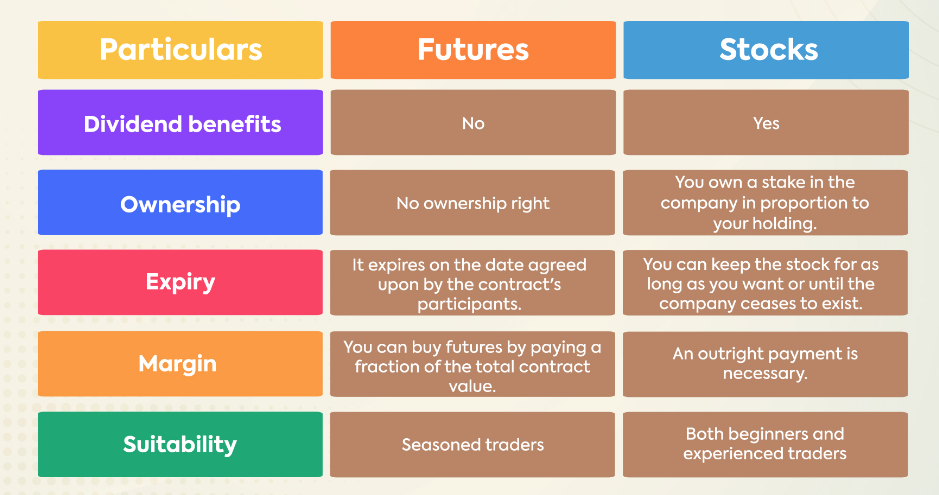

Step 1: Learn the basics of stock market investing. Before you invest in any stocks, you should understand what the stock market is, how it works, and what factors affect the prices of stocks. You should also know the different types of stocks, such as common stocks, preferred stocks, growth stocks, value stocks, and dividend stocks, and how they differ in terms of risk and return. You can find some useful information on stock market basics in or .

Step 2: Choose a brokerage account that suits your needs and preferences. A brokerage account is an online platform that allows you to buy and sell stocks and other securities. There are many different brokerage accounts available, and they vary in terms of fees, features, services, and investment options. You should compare different brokers and find one that meets your goals, budget, and level of experience. You can use to find the best broker for you.

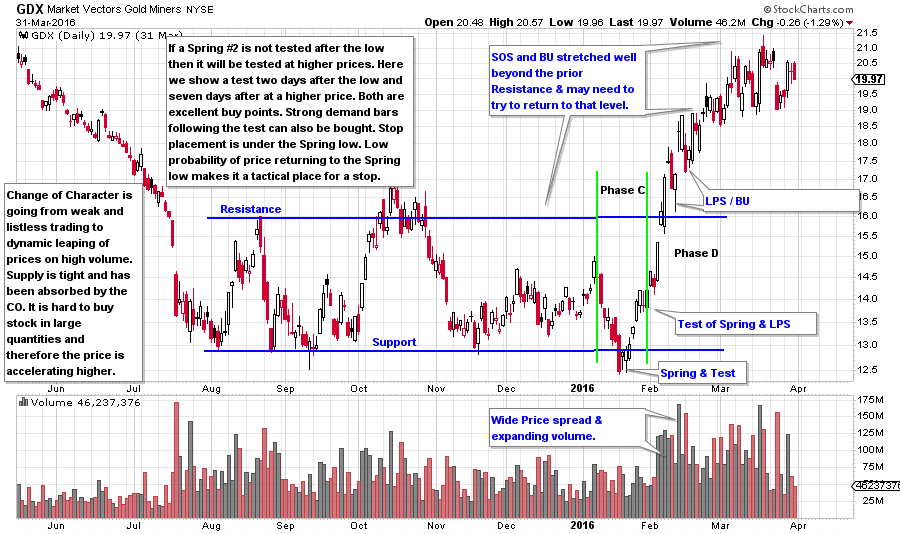

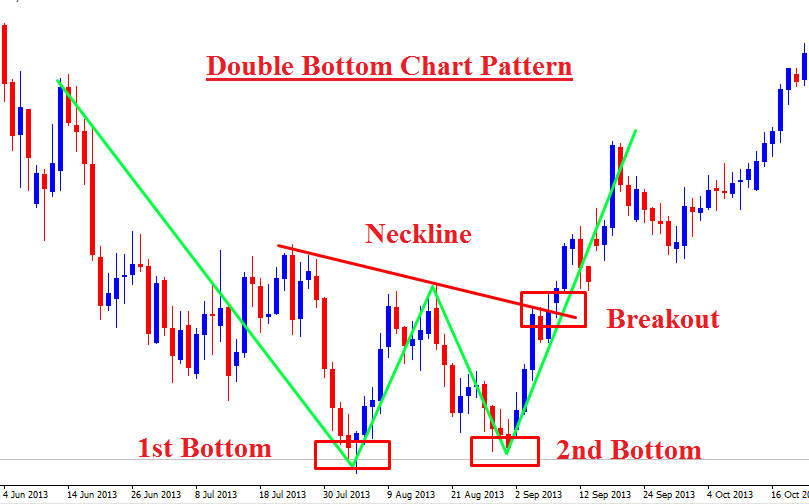

Step 3: Develop a stock investment strategy and stick to it. A stock investment strategy is a plan that guides your decisions on what stocks to buy, when to buy them, how much to invest, and when to sell them. There are many different stock investment strategies, such as value investing, growth investing, dividend investing, and technical analysis. You should choose a strategy that matches your risk tolerance, time horizon, and objectives, and follow it consistently. You can learn more about different stock investment strategies in .

Step 4: Diversify your portfolio and rebalance it periodically. Diversification is the practice of spreading your money across different stocks and other assets, such as bonds, commodities, and real estate. Diversification can help you reduce your risk and increase your returns by minimizing the impact of any single stock or market sector on your portfolio. Rebalancing is the process of adjusting your portfolio to maintain your desired level of diversification and risk. You should rebalance your portfolio at least once a year or whenever there are significant changes in your financial situation or the market conditions. You can find some tips on how to diversify and rebalance your portfolio in or .

or [this one].

I hope these steps help you systematically learn stock investment. Remember, stock investing is a learning process, and you should always seek to improve your knowledge and skills.