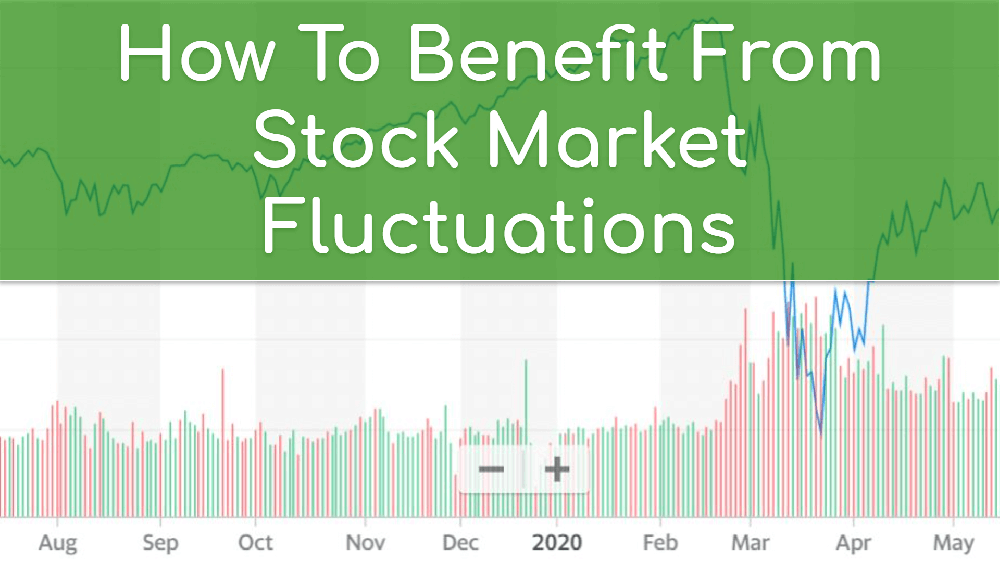

The principle of stock fluctuations is the idea that the prices of stocks change due to the forces of supply and demand, as well as other factors that influence the expectations and behaviors of buyers and sellers.

Supply and demand are the basic elements of any market, and they determine how much of a good or service is available and how much people are willing to pay for it. In the stock market, supply is the number of shares that are offered for sale, and demand is the number of shares that investors want to buy. When supply exceeds demand, prices tend to fall, and when demand exceeds supply, prices tend to rise.

However, supply and demand are not fixed or static, but rather dynamic and responsive to various influences. Some of these influences include:

Major financial news, such as earnings reports, mergers and acquisitions, product launches, regulatory changes, lawsuits, scandals, etc. These can affect the profitability, growth, reputation, and outlook of a company or an industry, and thus affect the demand for its stocks.

Natural disasters, wars, pandemics, political events, social movements, etc. These can affect the overall economic conditions, consumer confidence, market sentiment, and risk appetite of investors, and thus affect the supply and demand of stocks across different sectors and regions.

Investor reaction to company financials, such as revenue, earnings, cash flow, dividends, etc. These can indicate the financial health, performance, and value of a company, and thus affect the demand for its stocks.

Pricing speculation, such as forecasts, predictions, rumors, trends, etc. These can influence the expectations and beliefs of investors about the future direction and potential of a company or a market, and thus affect the demand for its stocks.

These influences can cause stock prices to fluctuate frequently, sometimes by large amounts, in a short period of time. However, not all stock prices fluctuate equally or in the same direction, as different stocks have different characteristics, such as market capitalization, industry, growth rate, dividend yield, beta, etc. These characteristics can affect how sensitive or responsive a stock is to the various influences mentioned above.

Therefore, the principle of stock fluctuations is not a simple or straightforward concept, but rather a complex and multifaceted one that requires careful analysis and interpretation. You can find some useful information on stock market fluctuations in , , or .