There are different ways to determine the value of a stock, such as fundamental analysis, technical analysis, or a combination of both. Fundamental analysis is the method of examining the financial statements, earnings, assets, liabilities, growth prospects, competitive advantage, and industry trends of a company. Technical analysis is the method of studying the price movements, patterns, trends, and indicators of a stock. You can use various tools and resources to conduct your research and analysis, such as financial websites, news outlets, company reports, analyst ratings, charts, and software.

Some of the common strategies that investors use to make money from stocks are:

Value investing: This strategy is a form of long-term investing that involves buying stocks that are undervalued by the market, based on their fundamentals, such as earnings, assets, dividends, and growth prospects. You can use tools such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, dividend yield, and return on equity (ROE) to find stocks that have low prices but high quality. You can then hold the stock until the market recognizes its true value and the price rises.

Growth investing: This strategy is another form of long-term investing that involves buying stocks that have high growth potential, based on their future earnings, revenues, products, or innovations. You can use tools such as earnings per share (EPS) growth rate, revenue growth rate, and return on invested capital (ROIC) to find stocks that have strong and sustainable growth. You can then hold the stock until it reaches your target price or until the growth slows down or stops.

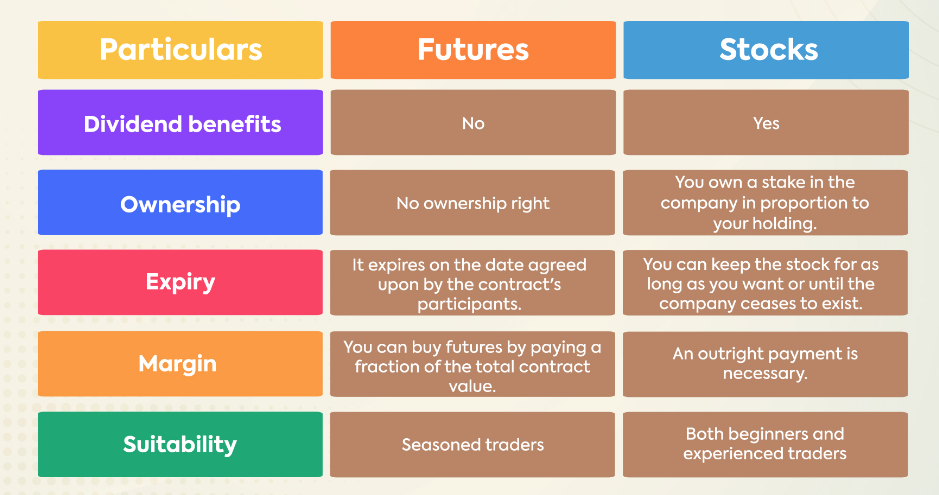

Dividend investing: This strategy is a form of income investing that involves buying stocks that pay regular and reliable dividends, which are distributions of a company’s profits to its shareholders. You can use tools such as dividend yield, dividend payout ratio, and dividend growth rate to find stocks that have high and stable dividends. You can then reinvest the dividends to buy more shares of the stock, or use them as a source of passive income.

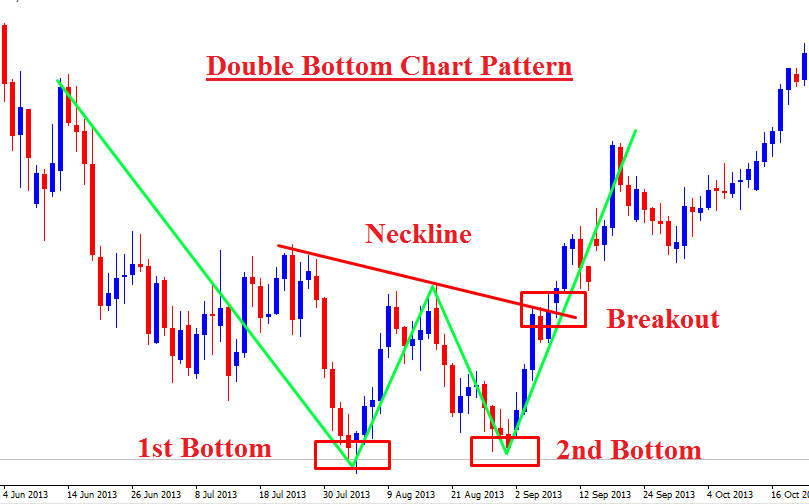

Momentum investing: This strategy is a form of short-term trading that involves buying stocks that are moving fast in one direction, either up or down. You can use tools such as volume, volatility, and relative strength index (RSI) to find stocks that have strong momentum and are likely to continue their trend. You can also use catalysts, such as news, rumors, or social media buzz, to trigger the momentum. You can then sell the stock when the momentum slows down or reverses.

Swing trading: This strategy is another form of short-term trading that involves holding the stock for a few days or weeks, depending on the market conditions. You can use technical analysis, such as trend lines, moving averages, and indicators, to identify the best entry and exit points for your trades. You can also use fundamental analysis, such as earnings reports, news events, and analyst ratings, to find stocks that have high potential for price movements.

These are just some examples of how to make money from stocks. However, there are many more strategies and techniques that you can use, depending on your goals, risk tolerance, and market conditions. You can learn more about these strategies and how to apply them from various resources, such as books, podcasts, courses, blogs, videos, and mentors. Some of the examples of these resources are:

, a classic book by Benjamin Graham that teaches the principles of value investing and how to analyze stocks.

, a website that provides stock market news, analysis, advice, and recommendations for beginners and experts alike.

, a free online course by Udemy that covers the basics of the stock market and how to invest in stocks.

, a blog by The Balance that offers educational articles, tips, and resources on how to invest in stocks.

[How to Invest in Stocks for Beginners], a video by ClearValue Tax that explains what stocks are, how to open a brokerage account, how to buy and sell stocks, and how to choose a style of investing.

I hope this information helps you understand the fundamental logic of making money from stocks.