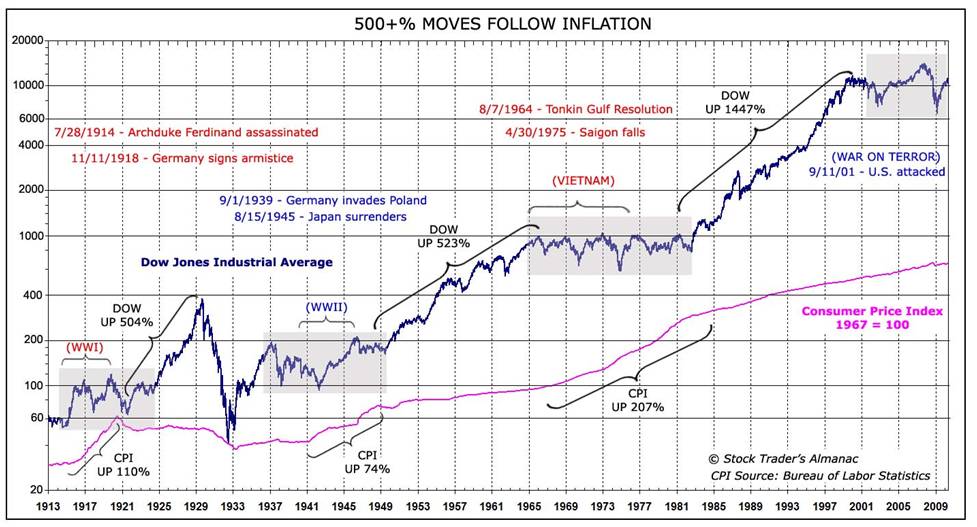

War can have both positive and negative impacts on the economy and the markets, depending on the nature, duration, and outcome of the conflict. Some of the factors that can influence the market reaction are:

The level of uncertainty and risk that war creates for investors and consumers. War can cause a sharp sell-off in stocks and a flight to safer assets like gold, bonds, or currencies perceived as safe havens. War can also reduce consumer confidence and spending, which can hurt the demand for goods and services.

The effect of war on oil and other commodity prices. War can disrupt the supply and transportation of oil and other commodities, which can lead to price spikes and inflation. Higher oil prices can increase the cost of production and transportation for many industries, as well as the cost of living for consumers. Higher inflation can erode the purchasing power of money and reduce the real returns on investments.

The impact of war on government spending and fiscal policy. War can increase government spending on defense and security, which can stimulate the economy and create jobs in certain sectors. However, war can also increase government debt and deficits, which can crowd out private investment and put pressure on interest rates and taxes. Higher interest rates can make borrowing more expensive for businesses and consumers, while higher taxes can reduce disposable income and consumption.

The outcome and aftermath of war. War can have different effects on the economy and the markets depending on whether it ends in a clear victory, a stalemate, or a defeat. A clear victory can boost the morale and confidence of the winning side, while a stalemate or a defeat can damage the reputation and credibility of the losing side. War can also create opportunities and challenges for reconstruction, development, and trade in the affected regions.

Based on these factors, the results suggest that the current wars and conflicts in the Middle East, Ukraine, Iran, and North Korea may have different implications for the US stock market and the real estate market. For example:

The Israel-Hamas war has cast a shadow on global financial markets, as Israeli stocks listed in New York and Tel Aviv have sunk to recent lows, underscoring the growing economic uncertainties in the war-torn region. However, the results also indicate that stocks have shown resilience over time and have often quickly recovered as the situation stabilizes or as the scope of the conflict becomes clearer.

The Russia-Ukraine invasion has already affected the US housing market, as the stock and cryptocurrency markets, where many buyers pull money from to purchase property, tumbled. The invasion has also raised the risk of a broader regional war, which may have a more severe impact on oil and other commodity prices, as well as on global trade and geopolitical relationships.

The Iran and North Korea nuclear threats have increased the tension and uncertainty in the international arena, which may affect the investor sentiment and market volatility. However, the results also suggest that the US has a strong military and economic advantage over these countries, which may limit the potential damage and escalation of the conflicts.