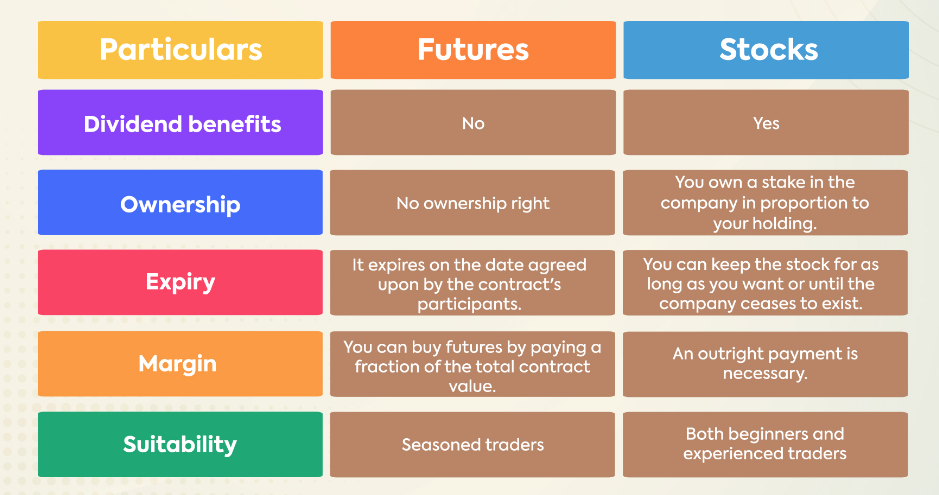

The difference between funds and stocks is a common question among investors who want to diversify their portfolio and achieve their financial goals. Here is a summary of the main differences between these two types of investments:

Funds are collections of money invested in various assets, such as stocks, bonds, or other securities. Stocks are shares of ownership in a single company.

Funds offer more diversification and risk control, as they reduce the impact of any single asset’s performance on the overall portfolio. Stocks are riskier and more volatile, as they depend on the performance of one company and can fluctuate significantly in price.

Funds may have lower returns and higher fees, as they are subject to management costs, expense ratios, and sales charges. Stocks can outperform the market index and have lower trading costs, as many brokerages do not charge fees for individual stocks.

Funds are settled at the end of each trading day, meaning that their price is determined by the net asset value (NAV) of their underlying assets. Stocks are traded during market hours, meaning that their price can change throughout the day based on supply and demand.

If you want to learn more about the pros and cons of funds and stocks, as well as how to choose and buy them, you can check out some of the following resources:

, a website that provides financial guidance, tools, and reviews for various topics, such as investing, banking, credit cards, loans, and insurance.

, a website that provides stock market news, analysis, advice, and recommendations for beginners and experts alike.

, a website that provides educational articles, videos, quizzes, and tutorials on various financial topics, such as the stock market, economics, accounting, personal finance, and trading.