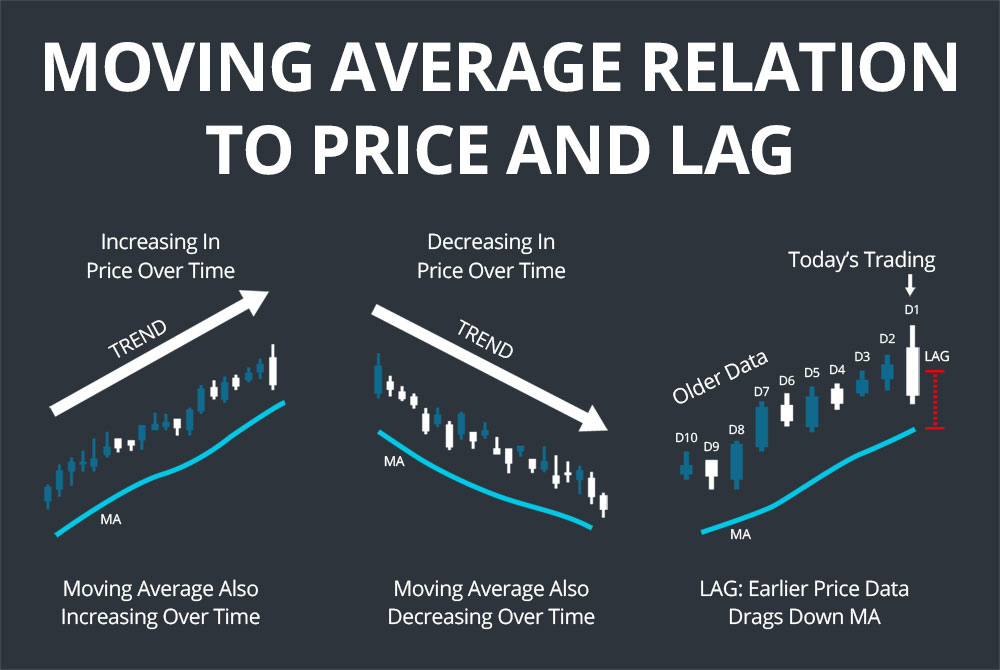

There are different types of moving averages, such as simple, exponential, and weighted. The simple moving average (SMA) is the most basic type, which gives equal weight to each price in the period. The exponential moving average (EMA) gives more weight to the recent prices, making it more responsive to the changes in the price. The weighted moving average (WMA) gives more weight to the prices according to a specific formula, such as the linear or the triangular weighting.

Some of the basic techniques for using the moving average are:

Trend identification: You can use the moving average to identify the trend of a stock by looking at its slope and direction. A rising moving average indicates that the stock is in an uptrend, while a falling moving average indicates that the stock is in a downtrend. You can also use multiple moving averages with different periods to confirm the trend. For example, if a shorter-term moving average crosses above a longer-term moving average, it is a bullish signal that the stock is in an uptrend. Conversely, if a shorter-term moving average crosses below a longer-term moving average, it is a bearish signal that the stock is in a downtrend.

Support and resistance: You can use the moving average to find the support and resistance levels of a stock by looking at its interaction with the price. Support is the level where the price tends to bounce up from, while resistance is the level where the price tends to fall down from. The moving average can act as a dynamic support or resistance level, depending on the trend. For example, in an uptrend, the moving average can act as a support level, where the price tends to find buyers and bounce up. In a downtrend, the moving average can act as a resistance level, where the price tends to find sellers and fall down.

Entry and exit: You can use the moving average to find the optimal entry and exit points for a stock by looking at its signals and patterns. There are many ways to use the moving average for entry and exit, such as breakouts, pullbacks, crossovers, and divergences. For example, a breakout is when the price moves above or below the moving average, indicating a change in the trend and momentum. A pullback is when the price retraces or corrects a portion of its previous move, indicating a pause or consolidation in the trend. A crossover is when the price or another moving average crosses the moving average, indicating a change in the direction and strength of the trend. A divergence is when the price and the moving average move in opposite directions, indicating a weakening or reversal of the trend.

These are some of the basic techniques for using the moving average, but they are not the only ones. You should also use other technical indicators and fundamental analysis to complement and confirm your trading decisions and manage your risk. You can learn more about the moving average and how to use it from the resources I found for you:

- This article provides an overview of the moving average, its types, and its uses.

- This article provides a guide on how to use the moving average for different strategies, such as trend trading, stop loss, and take profit.

- This article provides a tutorial on how to calculate and plot the moving average in Excel using formulas and charts.