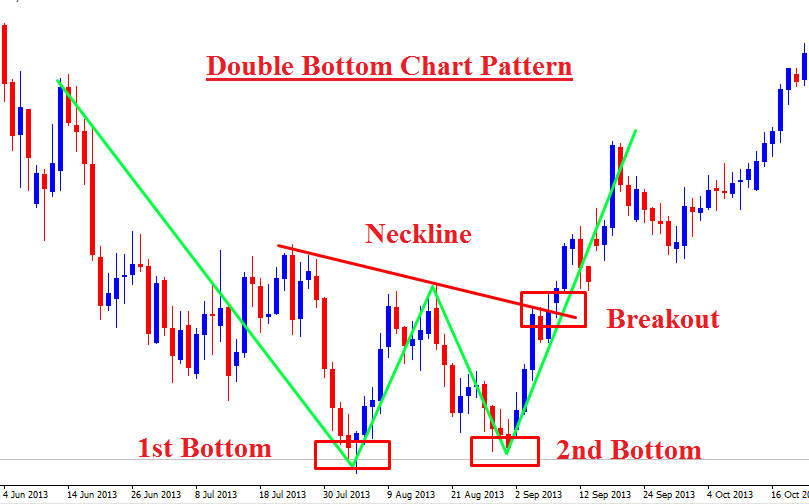

Price-signal trading: This strategy involves identifying a level at which the stock price has met support or resistance in the past, and then waiting for the price to break through that level with a strong momentum. This can indicate a change in the trend or a continuation of the trend, depending on the direction of the breakout. You can then enter the trade in the direction of the breakout and exit when the price reaches another level of support or resistance.

The ABC system: This strategy is based on finding and following an upward trend in the stock price. You can use a simple three-step method to identify the trend: A is the lowest price point, B is the highest price point, and C is the next lowest price point that is higher than A. When the price reaches C, you can buy the stock and ride the trend until it reverses.

Swing trading: This strategy is a form of short-term trading that involves holding the stock for a few days or weeks, depending on the market conditions. You can use technical analysis, such as trend lines, moving averages, and indicators, to identify the best entry and exit points for your trades. You can also use fundamental analysis, such as earnings reports, news events, and analyst ratings, to find stocks that have high potential for price movements.

Momentum trading: This strategy is another form of short-term trading that involves buying stocks that are moving fast in one direction, either up or down. You can use tools such as volume, volatility, and relative strength index (RSI) to find stocks that have strong momentum and are likely to continue their trend. You can also use catalysts, such as news, rumors, or social media buzz, to trigger the momentum. You can then sell the stock when the momentum slows down or reverses.

Value investing: This strategy is a form of long-term investing that involves buying stocks that are undervalued by the market, based on their fundamentals, such as earnings, assets, dividends, and growth prospects. You can use tools such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, dividend yield, and return on equity (ROE) to find stocks that have low prices but high quality. You can then hold the stock until the market recognizes its true value and the price rises.

These are just some examples of simple and efficient stock trading strategies that you can use to improve your trading performance. However, you should always do your own research, analysis, and risk management before you trade any stock. You should also test your strategies on a demo account or with small amounts of money before you trade with real money. Trading stocks can be rewarding, but it can also be risky and challenging. Therefore, you should always trade with caution and discipline.