As investors eagerly await Federal Reserve Chairman Jerome Powell's remarks, futures markets are showing signs of subdued activity. With the anticipation surrounding Powell's speech, market participants are treading cautiously, bracing for potential volatility ahead.

The Federal Reserve's actions and statements have always been closely watched by investors, as they provide crucial insights into the central bank's monetary policy stance. Powell's remarks, scheduled for later this week, are expected to shed light on the Fed's plans for interest rates and its assessment of the current economic landscape.

In recent months, the market has been grappling with concerns over inflation and the potential impact on interest rates. Rising prices across various sectors of the economy have fueled fears that the Fed might have to tighten its monetary policy sooner than expected. Investors are keen to hear Powell's views on these issues and how the central bank plans to address them.

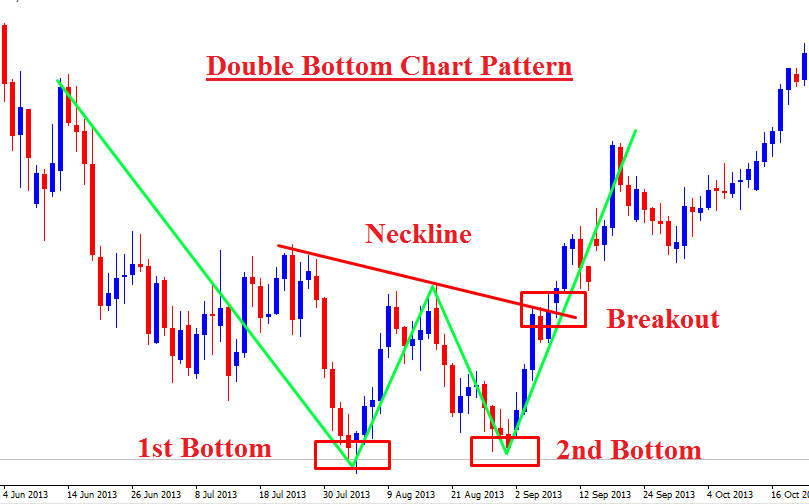

The subdued nature of futures markets suggests that investors are adopting a wait-and-see approach. They are hesitant to make significant moves until they have a clearer understanding of the Fed's intentions. This cautious sentiment is reflected in the relatively low trading volumes and narrow price ranges observed in futures contracts.

The importance of Powell's remarks cannot be overstated. His words have the potential to sway market sentiment and influence investment decisions. Investors will be closely analyzing every nuance of his speech, searching for clues about future monetary policy actions.

One key area of interest is the Fed's stance on interest rates. Currently, the central bank has maintained a near-zero interest rate policy to support economic recovery. However, with inflationary pressures mounting, there is growing speculation that the Fed might have to raise rates sooner than anticipated. Powell's comments on this matter will be scrutinized for any hints or indications.

Another topic likely to be addressed is the Fed's bond-buying program. The central bank has been purchasing large quantities of government bonds to inject liquidity into the financial system and support borrowing costs. Investors will be eager to hear Powell's thoughts on when and how the Fed plans to taper these asset purchases.

Additionally, Powell may provide insights into the central bank's assessment of the overall economic recovery. While the U.S. economy has rebounded strongly from the depths of the pandemic-induced recession, there are still uncertainties and risks that need to be considered. Investors will be looking for guidance on how the Fed views these challenges and what measures it might take to address them.

The outcome of Powell's remarks has the potential to shape market dynamics in the short term and beyond. Depending on his comments, we could see increased volatility or a continuation of the current subdued market environment. Traders and investors will need to be nimble and prepared to adjust their strategies accordingly.

It is worth noting that while Powell's remarks are highly anticipated, they are just one piece of the puzzle. Economic data, corporate earnings, and geopolitical developments will also play a significant role in shaping market sentiment. Investors must consider a holistic view of all these factors when making investment decisions.

In conclusion, futures markets are exhibiting subdued activity as investors await Federal Reserve Chairman Jerome Powell's remarks. The cautious sentiment reflects investors' desire for clarity on key issues such as interest rates, bond-buying programs, and the overall economic recovery. Powell's comments will likely have a significant impact on market sentiment and investment decisions in the days ahead. Traders and investors must remain vigilant and adaptable as they navigate through these uncertain times.