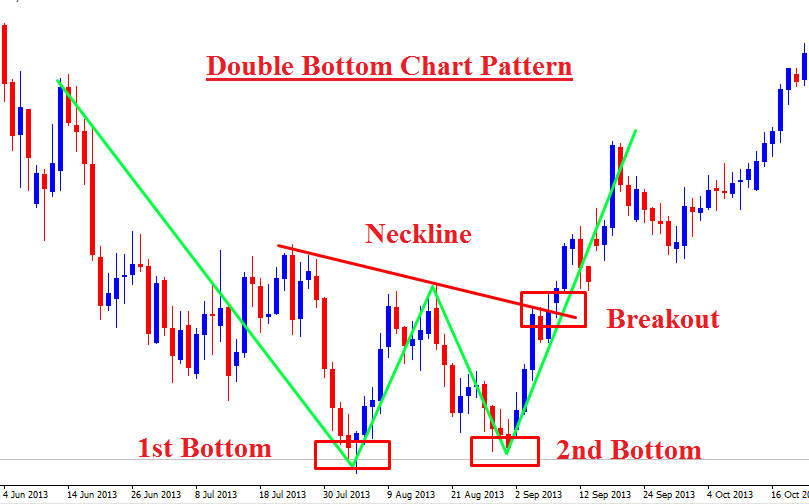

Using trendlines: A trendline is a line that connects the higher highs or lower lows of the price to indicate the direction and strength of the trend. A stock is in an upward trend if the price is above the rising trendline, and in a downward trend if the price is below the falling trendline. A break of the trendline could signal a reversal or a correction of the trend.

Using moving averages: A moving average is a line that smoothes out the daily fluctuations of the price and shows the average price over a certain period. A stock is in an upward trend if the price is above the rising moving average, and in a downward trend if the price is below the falling moving average. A crossover of the price and the moving average could signal a change in the trend direction. There are different types of moving averages, such as simple, exponential, or weighted, and different periods, such as short-term, medium-term, or long-term.

Using technical indicators: A technical indicator is a mathematical calculation based on the price and/or volume of a stock that provides additional information about the trend, momentum, volatility, or strength of the stock. Some of the popular indicators that can help confirm a trend are the relative strength index (RSI), the moving average convergence divergence (MACD), the average directional index (ADX), and the rate of change (ROC). Each indicator has its own formula, parameters, and interpretation, and they can be used in combination or separately.

To confirm whether a stock is in an upward or downward trend, you need to apply the appropriate method for your trading style, time horizon, and risk tolerance. You also need to consider the overall market conditions, the sector performance, and the fundamental factors that affect the stock. No method is perfect or foolproof, so you should always use multiple sources of information and analysis before making a trading decision.