Fundamental analysis: This method focuses on the financial performance, growth prospects, competitive advantage, and valuation of a company. It uses data from sources such as financial statements, earnings reports, economic indicators, and industry trends to estimate the fair or intrinsic value of a stock. A stock that is trading below its fair value is considered undervalued and a good buy, while a stock that is trading above its fair value is considered overvalued and a good sell. Fundamental analysis can help investors find quality companies that have strong fundamentals and long-term potential.

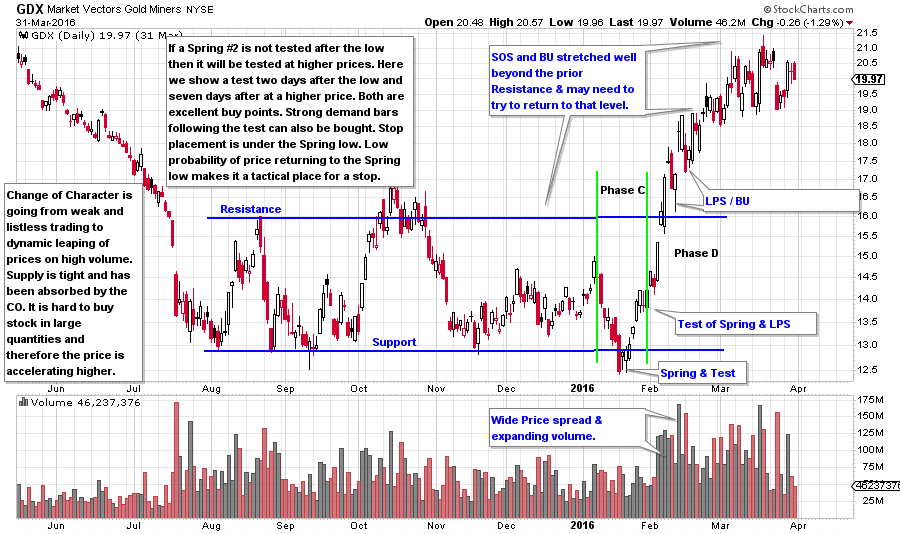

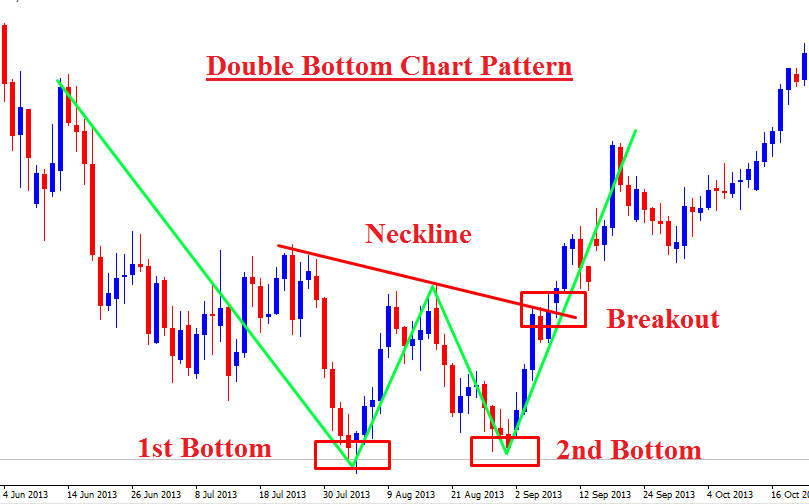

Technical analysis: This method focuses on the price and volume movements of a stock and the patterns and signals they form. It uses tools such as charts, indicators, and trend lines to analyze the behavior and sentiment of the market and the stock. A stock that is in an uptrend (making higher highs and higher lows) is considered bullish and a good buy, while a stock that is in a downtrend (making lower highs and lower lows) is considered bearish and a good sell. Technical analysis can help traders find optimal entry and exit points for a stock based on its momentum and direction.

Sentiment analysis: This method focuses on the opinions and emotions of the market participants and the public towards a stock. It uses sources such as news articles, social media posts, analyst ratings, and surveys to gauge the level of optimism or pessimism about a stock. A stock that has a high level of positive sentiment is considered popular and a good buy, while a stock that has a high level of negative sentiment is considered unpopular and a good sell. Sentiment analysis can help investors and traders anticipate and exploit market reactions and trends .

These are some of the truly simple and effective stock analysis methods that you can use to evaluate and select stocks. However, you should also do your own due diligence and research before investing in any stock, as the stock market is subject to various risks and uncertainties. You should also diversify your portfolio across different sectors, industries, and asset classes to reduce your exposure to any single source of risk.